August 14, 2025

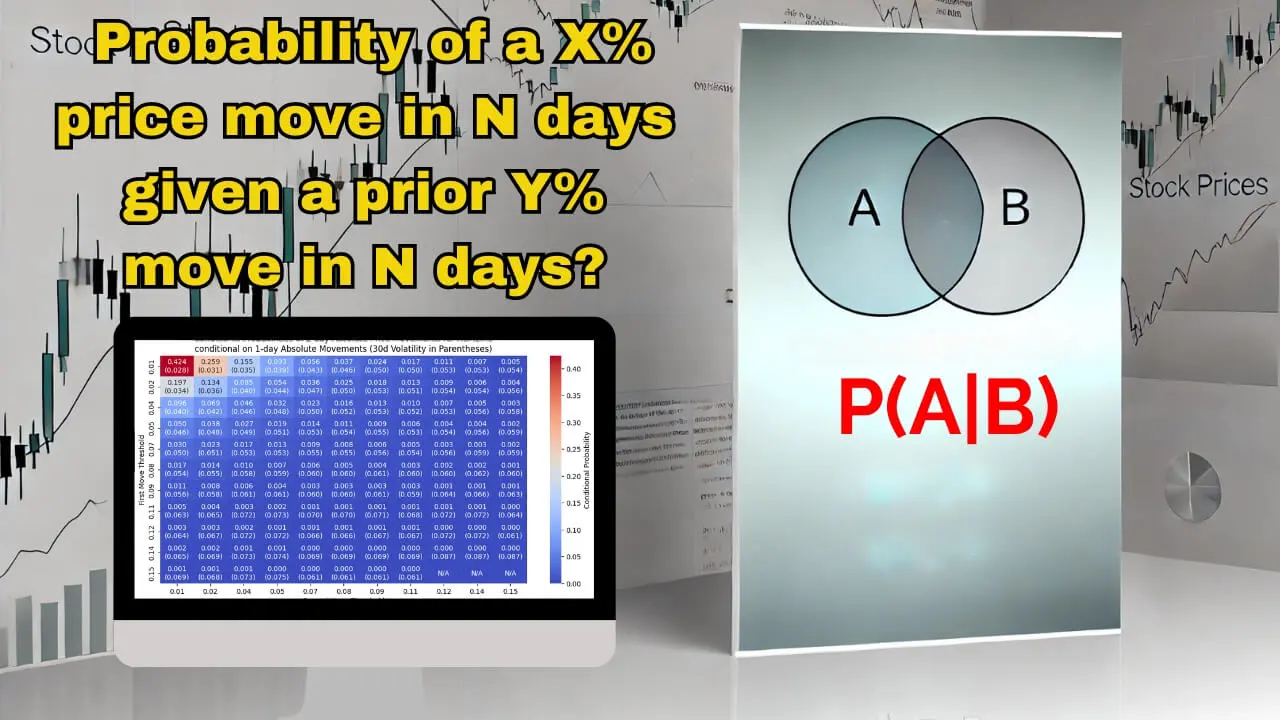

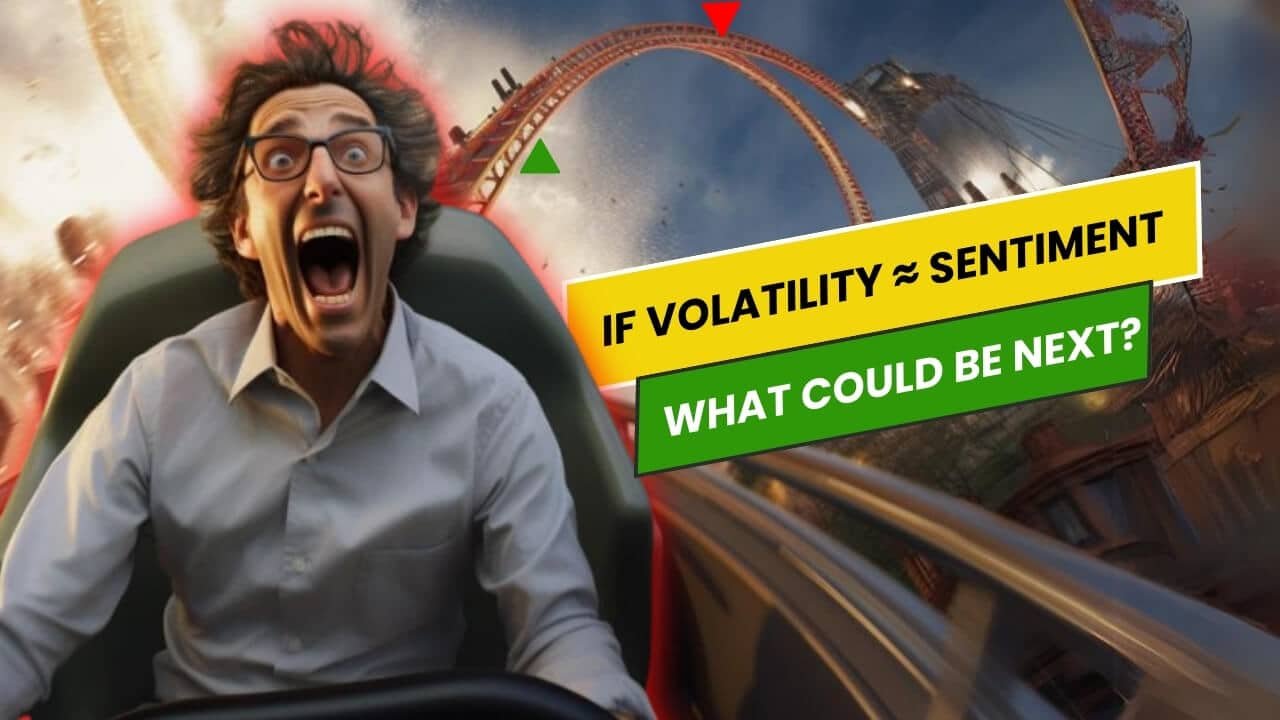

Visualize Trends with Multi-Band ATR

Integrate rolling ATR deviation bands, short-term trend scoring, and contextual price histograms to reveal trend strength Most indicators track direction or volatility, but not both. Certainly, they almost never show you where price is clustering