Using the Merton Model to estimate credit risk, simulate default probabilities, and assess financial stability

Traditional credit ratings are slow to react. The market moves faster. Investors and risk analysts need a real-time measure of financial distress — one that reflects changing market conditions, not outdated financial statements.

The Merton Model offers a solution. It treats a company’s equity as a call option on its assets, allowing us to estimate default risk directly from market prices. The key output, Distance to Default, DTD, quantifies how close a firm is to financial distress.

Use Entreprenerdly’s tool to quantify the risk of company bankruptcy in real-time:

In this guide, we’ll show:

- How the Merton Model works in simple terms

- How to estimate asset value and default risk using market data

- How to apply this model in Python for real-time credit risk assessment

1. The Merton Model

Why Traditional Credit Risk Models Fall Short

Traditional credit risk models rely on accounting-based indicators — metrics like debt ratios, interest coverage, and credit ratings.

The problem is that they’re backward-looking. Financial statements are updated quarterly at best, while credit ratings often lag market conditions by months. By the time distress appears in the books, the market has already reacted.

Market-Based Risk Models: A Better Approach

A firm’s stock price incorporates all available information, reacting instantly to new risks, economic shifts, and investor sentiment.

The Merton Model leverages this by treating a company’s equity as a call option on its assets, which then allows us to estimate default risk in real time.

Instead of relying on stale financials, the Merton Model extracts risk directly from:

- Market capitalization (E) — reflecting investor expectations

- Stock volatility (σ_E) — capturing uncertainty in the firm’s value

- Debt levels (D) — providing the default threshold

The Merton Model Explained

Merton’s insight: Equity is a call option on the firm’s assets.

- Shareholders own the firm’s assets (A).

- They must repay debt (D) at maturity (T).

- If A > D, they keep the difference. If A < D, they default, and bondholders take over.

This follows the Black-Scholes-Merton option pricing framework, where equity value follows:

where

Each term represents:

- A = Asset value (firm’s total economic value)

- D = Default point (debt obligation)

- E = Market value of equity

- σA = Asset volatility (uncertainty in firm’s total value)

- r = Risk-free rate

- N(d) = Cumulative probability from the standard normal distribution

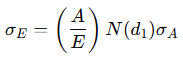

Linking Equity Volatility to Asset Volatility

Since we observe equity (E) in the market but not assets (A) directly, we solve for A and σA using this additional equation:

- σE = Observed equity volatility

- σA = Unobserved asset volatility (to be estimated)

These two equations form a nonlinear system, solved numerically to estimate A and σA.

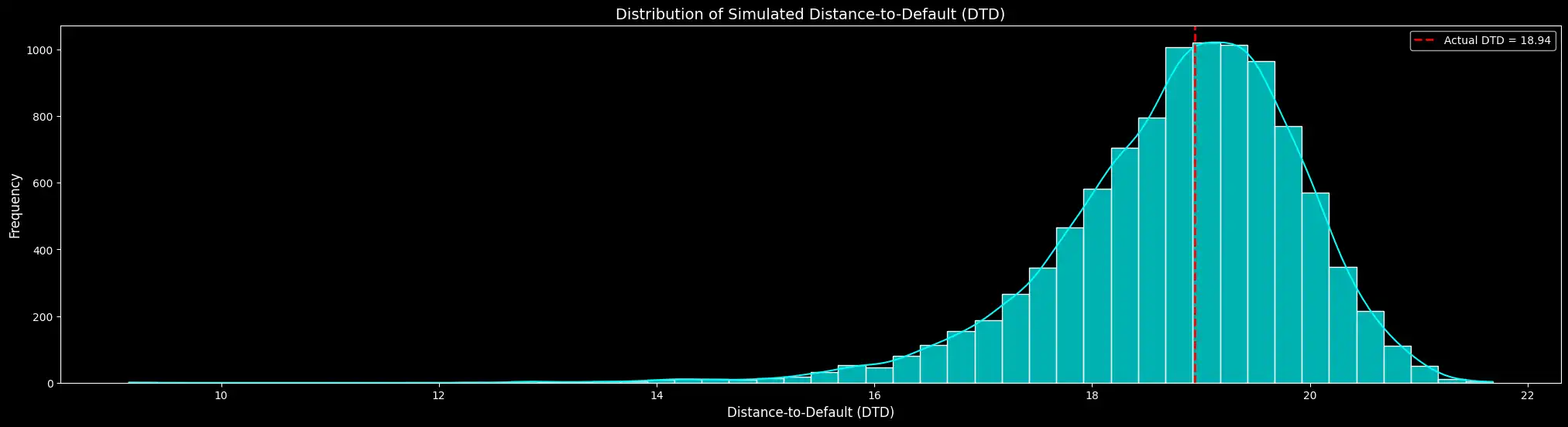

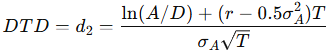

Distance to Default: Measuring Default Risk

Once we estimate A and σA, we compute Distance to Default — a measure of how many standard deviations a firm’s assets are from default:

- Higher DTD → If large, the firm has a financial cushion.

- Lower DTD → If close to zero, the firm is near default.

2. Implementation in Python

Now, let’s apply the Merton Model in Python to estimate default risk in real time.

Extracting Market Data for Model Inputs

To implement the model, we first need to fetch equity value, stock volatility, and debt levels. We can get this using the yfinance library.

Lets start with Debt. Different approaches to measuring debt can impact the DTD calculation and the firm’s perceived financial risk:

- Total Debt: Uses the total reported debt — This assumes that all obligations contribute equally to default risk.

- Short-Term + Long-Term Debt: Adds both components directly — Gives a more detailed breakdown but assumes all reported liabilities are fully relevant.

- Short-Term + Half of Long-Term Debt: A common approximation method — This reflects that long-term obligations may be partially refinanced or restructured before default.

Via the method argument in the function below, you can adjust for your preferred method.

When choosing the method, consider the following:

- A higher debt value (D) leads to a lower DTD. This indicates higher default risk.

- A lower debt value may underestimate risk. This makes the firm seem safer than it actually is.

Choosing the appropriate debt measure depends on the context of financial analysis and the firm’s borrowing structure.

# Extract debt from balance sheet with multiple methods

def get_debt_from_balance_sheet(balance_sheet, info, method="STplusHalfLT", fallback=1e6):

"""

Fetches debt based on the selected method.

Methods:

"TOTAL" -> Uses the 'Total Debt' value from the balance sheet.

"STplusHalfLT" -> Short-term debt + 0.5 * long-term debt (default).

"STplusLT" -> Short-term debt + long-term debt.

If debt data is unavailable, falls back to info["totalDebt"] or a predefined fallback value.

Inputs:

balance_sheet = DataFrame containing balance sheet data.

info = Dictionary with company metadata.

method = Debt extraction method.

fallback = Default debt value if no valid data is found.

Returns:

debt_val = Computed debt amount.

"""

debt_val = None

short_debt = 0.0

long_debt = 0.0

total_debt = 0.0

# Extract short-term debt

try:

short_debt = balance_sheet.loc["Short Term Debt"][0]

if not np.isfinite(short_debt) or short_debt < 0:

short_debt = 0.0

except:

pass

# Extract long-term debt

try:

long_debt = balance_sheet.loc["Long Term Debt"][0]

if not np.isfinite(long_debt) or long_debt < 0:

long_debt = 0.0

except:

pass

# Extract total debt

try:

total_debt = balance_sheet.loc["Total Debt"][0]

if not np.isfinite(total_debt) or total_debt < 0:

total_debt = 0.0

except:

pass

# If all values are missing, fallback to info["totalDebt"]

if short_debt == 0.0 and long_debt == 0.0 and total_debt == 0.0:

fallback_debt = info.get("totalDebt", 0)

if fallback_debt is not None and fallback_debt > 0:

total_debt = fallback_debt

# Compute debt based on the selected method

if method.upper() == "TOTAL":

debt_val = total_debt

elif method.upper() == "STPLUSLT":

debt_val = short_debt + long_debt

else: # Default or "STplusHalfLT"

debt_val = short_debt + 0.5 * long_debt

# Final check to ensure a valid debt value

if debt_val is None or debt_val <= 0:

debt_val = fallback

return debt_val

Define the key parameters used in the Merton Model.

Modify these settings to analyze different companies and market conditions. The parameters include:

- Ticker Symbol: The stock to analyze.

- Time Horizon (T): The forecast period in years.

- Risk-Free Rate (r): The assumed risk-free interest rate.

- Debt Extraction Method: The approach used to estimate total debt.

- Volatility Calculation Period: The historical period for computing stock volatility.

# Define user-controlled settings

ticker_symbol = "AAPL" # Change this to analyze a different stock

# Model Parameters

T = 1.0 # Time horizon in years

r = 0.04 # Risk-free interest rate (annual)

debt_method = "STplusHalfLT" # Options: "TOTAL", "STplusHalfLT", "STplusLT"

debt_factor = 1.0 # Scaling factor applied to debt

# Volatility Calculation

historical_period = "1y" # Period used to compute equity volatility (e.g., "1y", "2y", "6mo")

annualization_factor = 252 # Annualization factor for daily stock returns

Next, we get:

- Stock price (

regularMarketPrice) - Shares outstanding (

sharesOutstanding) - Historical stock prices (for volatility estimation)

The stock’s market cap (E) is calculated from price × shares outstanding. Equity volatility (σE) is estimated from historical log returns, annualized over 252 trading days.

Newsletter