Portfolio optimization across multiple factors - Dividends, Returns, Volatility, CVaR, and more

Multi-objective Portfolio optimization considers multiple objectives simultaneously, such as maximizing returns, minimizing risk, and enhancing diversification, to build a portfolio that aligns with the investor’s goals across multiple factors.

In this article, we’ll optimize a portfolio based on multiple objectives, such as dividend yields, maximise returns, maximise Sharpe ratio, and more.

We offer end-to-end implementation code using Google Colab Notebook. Additionally, Entreprenerdly’s automated portfolio optimization tool is available here.

The tool allows investors to directly implement various portfolio optimization techniques to best suit their individual risk preferences and return expectations.

We’ll discuss and implement the following concepts:

- Defining Objectives Function

- Returns, Risk, Dividends, etc

- Retrieving weights

- Parameters Grid Search

- Rebalancing Periods

- Best Possible Portfolio

- Assessing Portfolio Performance

- Performance Attribution

- Allocation, Selection, Interaction Effect

- Sector Allocation Risks

- Rolling Performance Metrics

2. Multi-Objective Portfolio Optimization

2.1 Approach and Methodology

The methodology involves defining various objectives and constraints to optimize the portfolio. The core approach in optimizing a multi-objective portfolio revolves around balancing several investment goals simultaneously.

1. Define Objectives and Constraints

Each objective represents a specific goal we want the portfolio to achieve, such as maximizing returns or minimizing risk. Constraints ensure the portfolio remains realistic and feasible, like ensuring the sum of asset weights equals one.

2. Formulate the Objective Function

We create a single objective function that incorporates all the individual objectives. The function quantifies how well the portfolio meets each goal. For instance, if we want to maximize returns and minimize risk, the objective function could look like this:

Here, ∑(wi⋅μi) represents the portfolio’s expected return, and sqrt{wT⋅Σ⋅w} represents the portfolio’s risk.

3. Weighting the Objectives

Not all objectives are equally important. We assign weights to each objective based on their relative importance. This step helps prioritize certain goals over others to reflect the investor’s preferences.

4. Optimization Algorithm

We use Sequential Least Squares Programming (SLSQP) to find the optimal set of asset weights. The algorithm iteratively adjusts the weights to minimize or maximize the objective function while adhering to the constraints. The goal is to find the set of weights that best achieves the defined objectives.

5. Periodic Rebalancing

Portfolios are rebalanced periodically to ensure they stay aligned with the original objectives. During rebalancing, we adjust the asset weights to account for market changes and shifts in the investor’s goals.

2.2 The Objectives to Optimize

The following objectives can be customized by setting them to 'true' or 'false' in the implementation code, based on whether the user wants to include them in the optimization process.

Maximize Return

We aim to maximize the expected return of the portfolio by calculating the weighted sum of mean returns. The objective value is adjusted by subtracting this weighted sum:

where wi represents the weight of asset i and μi is the expected return of asset i.

Minimize Risk

To minimize risk, we consider the portfolio’s volatility (standard deviation). This is achieved by adding the portfolio’s standard deviation to the objective value:

Σ is the covariance matrix of asset returns.

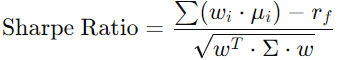

Maximize Sharpe Ratio

The Sharpe ratio measures risk-adjusted return. We calculate it and subtract it from the objective value:

where rf is the risk-free rate.

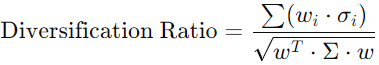

Maximize Diversification

Diversification is assessed by comparing the weighted sum of individual asset volatilities to the portfolio’s volatility. This ratio is subtracted from the objective value:

Other measures, such as HHI (Herfindahl-Hirschman Index), could be used instead.

Minimize CVaR

Conditional Value at Risk (CVaR) represents the expected loss in the worst-case scenario. The objective value is increased by adding the 5th percentile of portfolio returns:

Minimize Transaction Costs

To account for transaction costs, we assume a previous portfolio with equal weights. The costs are calculated and added to the objective value:

where wi,prev is the previous weight of asset i.

Maximize Dividend Yield

We maximize dividend yield by subtracting the weighted sum of dividend yields from the objective value:

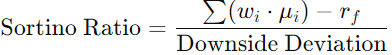

Maximize Sortino Ratio

The Sortino ratio focuses on downside risk. It is calculated and subtracted from the objective value:

Maximize Upside Potential Ratio

This ratio compares the mean of positive returns to downside risk. The ratio is subtracted from the objective value:

Minimize Beta

Beta measures the portfolio’s volatility relative to the market. We add the portfolio beta to the objective value:

2.4 Python Implementation

2.4.1 Core Functions

Lets discuss now the essential functions required for multi-objective portfolio optimization using Python. These functions facilitate data download, metric calculations, optimization, and visualization:

Dynamic Data Alignment: In

portfolio_beta, the function dynamically aligns the portfolio’s returns with the benchmark returns usingalign. This ensures both datasets are on the same date range, preventing misalignment issues that could skew results.Handling Missing Data: The

calculate_metricsfunction drops any rows with missing data (dropna). This is needed as financial data often contains gaps due to holidays.Multi-Objective Optimization: The

multi_objective_functionallows the inclusion or exclusion of various objectives such as maximizing return, minimizing risk, or maximizing dividend yield. Each objective modifies theobj_value, balancing trade-offs according to user-defined priorities.Periodic Rebalancing: The

rebalance_portfoliofunction ensures that the portfolio stays aligned with the defined objectives by adjusting the weights periodically as market conditions change.Realistic Constraints: The

optimize_portfoliofunction includes constraints to ensure that the sum of weights equals 1 and that all weights are between 0 and 1.

import yfinance as yf

import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

from scipy.optimize import minimize

from pypfopt import risk_models, expected_returns

import json

# Function to download adjusted close prices for given tickers

def download_data(tickers, start, end):

return yf.download(tickers, start=start, end=end)['Adj Close']

# Function to calculate returns, mean returns, and covariance matrix

def calculate_metrics(data):

returns = data.pct_change().dropna() # Calculate daily returns

mean_returns = expected_returns.mean_historical_return(data) # Calculate mean returns

cov_matrix = risk_models.sample_cov(data) # Calculate covariance matrix

return returns, mean_returns, cov_matrix

# Function to get dividend yields for given tickers

def get_dividend_yields(tickers):

dividend_yields = {}

for ticker in tickers:

stock = yf.Ticker(ticker)

info = stock.info

# Get dividend yield or set to 0 if not available

dividend_yield = info.get('dividendYield') or info.get('trailingAnnualDividendYield', 0)

if dividend_yield is None:

dividend_yield = 0

dividend_yields[ticker] = dividend_yield

return pd.Series(dividend_yields)

# Function to calculate portfolio beta

def portfolio_beta(weights, returns, benchmark_returns):

aligned_returns, aligned_benchmark = returns.align(benchmark_returns, join='inner', axis=0)

cov_matrix = np.cov(aligned_returns.T, aligned_benchmark)

beta = cov_matrix[:-1, -1] / np.var(aligned_benchmark)

return np.sum(weights * beta)

# Function to calculate Sortino ratio

def sortino_ratio(weights, returns, risk_free_rate=0.01):

portfolio_return = np.dot(weights, returns.mean())

downside_returns = np.minimum(returns - risk_free_rate, 0)

downside_deviation = np.sqrt(np.mean(downside_returns ** 2))

return (portfolio_return - risk_free_rate) / downside_deviation

# Function to calculate Upside Potential Ratio

def upside_potential_ratio(weights, returns, risk_free_rate=0.01):

portfolio_return = np.dot(weights, returns.mean())

upside_returns = np.maximum(returns - risk_free_rate, 0)

downside_returns = np.minimum(returns - risk_free_rate, 0)

downside_deviation = np.sqrt(np.mean(downside_returns ** 2))

upside_potential = np.mean(upside_returns)

return upside_potential / downside_deviation

# Multi-objective function for portfolio optimization

def multi_objective_function(weights, mean_returns, cov_matrix, dividend_yields, benchmark_returns, risk_free_rate=0.01):

obj_value = 0 # Initialize the objective value to 0

if maximize_return:

# If we want to maximize return, subtract the weighted sum of mean returns from the objective value

obj_value -= np.dot(weights, mean_returns) # Maximize return

if minimize_risk:

# If we want to minimize risk, add the portfolio volatility (standard deviation) to the objective value

obj_value += np.sqrt(np.dot(weights.T, np.dot(cov_matrix, weights))) # Minimize risk

if maximize_sharpe:

# If we want to maximize the Sharpe ratio, calculate it and subtract from the objective value

portfolio_return = np.dot(weights, mean_returns) # Expected portfolio return

portfolio_volatility = np.sqrt(np.dot(weights.T, np.dot(cov_matrix, weights))) # Portfolio volatility

sharpe_ratio = (portfolio_return - risk_free_rate) / portfolio_volatility # Sharpe ratio calculation

obj_value -= sharpe_ratio # Maximize Sharpe ratio

if maximize_diversification:

# If we want to maximize diversification, calculate the diversification ratio and subtract it from the objective value

w_vol = np.dot(weights.T, np.sqrt(np.diag(cov_matrix))) # Weighted volatilities of individual assets

p_vol = np.sqrt(np.dot(weights.T, np.dot(cov_matrix, weights))) # Portfolio volatility

diversification_ratio = w_vol / p_vol # Diversification ratio calculation

obj_value -= diversification_ratio # Maximize diversification

if minimize_cvar:

# If we want to minimize Conditional Value at Risk (CVaR), calculate it and add to the objective value

cvar = np.percentile(np.dot(returns.values, weights), 5) # CVaR calculation

obj_value += cvar # Minimize CVaR

if minimize_transaction_costs:

# If we want to minimize transaction costs, calculate them and add to the objective value

prev_weights = np.ones(len(weights)) / len(weights) # Assume equal weights previously

transaction_costs = np.sum(np.abs(weights - prev_weights)) * 0.001 # Assume 0.1% cost for transactions

obj_value += transaction_costs # Minimize transaction costs

if maximize_dividend_yield:

# If we want to maximize dividend yield, subtract the weighted sum of dividend yields from the objective value

obj_value -= np.dot(weights, dividend_yields) # Maximize dividend yield

if maximize_sortino:

# If we want to maximize the Sortino ratio, calculate it and subtract from the objective value

obj_value -= sortino_ratio(weights, returns, risk_free_rate) # Maximize Sortino ratio

if maximize_upside_potential:

# If we want to maximize the Upside Potential Ratio, calculate it and subtract from the objective value

obj_value -= upside_potential_ratio(weights, returns, risk_free_rate) # Maximize Upside Potential Ratio

if minimize_beta:

# If we want to minimize beta, calculate it and add to the objective value

obj_value += portfolio_beta(weights, returns, benchmark_returns) # Minimize Beta

return obj_value # Return the final objective value

# Function to optimize portfolio based on given metrics

def optimize_portfolio(mean_returns, cov_matrix, dividend_yields, benchmark_returns):

num_assets = len(mean_returns)

init_guess = num_assets * [1. / num_assets,] # Initial guess for weights

constraints = ({'type': 'eq', 'fun': lambda x: np.sum(x) - 1}, {'type': 'ineq', 'fun': lambda x: x}) # Constraints

bounds = [(0, 1) for _ in range(num_assets)] # Bounds for weights

result = minimize(multi_objective_function, init_guess, args=(mean_returns, cov_matrix, dividend_yields, benchmark_returns),

method='SLSQP', bounds=bounds, constraints=constraints)

return result.x

# Function to calculate cumulative returns

def calculate_cumulative_returns(returns, weights):

portfolio_returns = returns.dot(weights)

return (1 + portfolio_returns).cumprod()

# Function to plot cumulative returns

def plot_results(portfolio_cumulative, sp500_cumulative, equal_weighted_cumulative):

plt.figure(figsize=(10, 6))

plt.plot(portfolio_cumulative, label='Multi-Objective Optimization Portfolio')

plt.plot(sp500_cumulative, label='S&P 500')

plt.plot(equal_weighted_cumulative, label='Equal Weighted Portfolio')

plt.xlabel('Date')

plt.ylabel('Cumulative Returns')

plt.title('Cumulative Returns Over Time')

plt.legend()

plt.show()

# Function to rebalance portfolio periodically

def rebalance_portfolio(data, tickers, rebalance_period):

rebalanced_weights = []

dates = pd.date_range(start=data.index[0], end=data.index[-1], freq=f'{rebalance_period}M')

for date in dates:

if date in data.index:

subset_data = data[:date] # Data up to the current date

returns, mean_returns, cov_matrix = calculate_metrics(subset_data)

benchmark_returns = benchmark_data[:date].pct_change().dropna()

dividend_yields = get_dividend_yields(tickers)

weights = optimize_portfolio(mean_returns, cov_matrix, dividend_yields, benchmark_returns)

rebalanced_weights.append((date, weights))

return rebalanced_weights

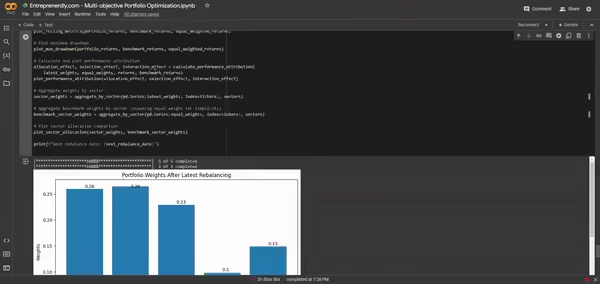

2.4.2 Main Execution

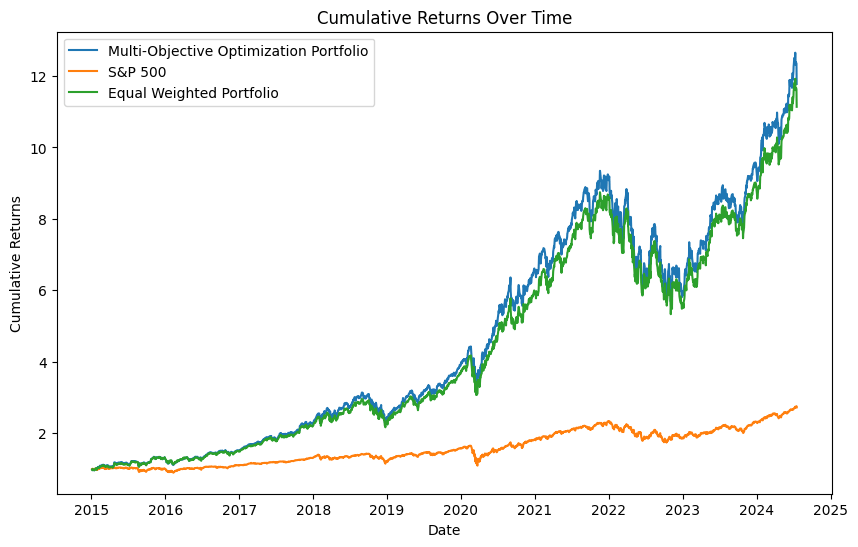

We execute now the main functions, considering the following steps:

Define Global Objectives: We set variables, to true or false, to outline the portfolio optimization goals.

Download and Calculate Metrics: Using

download_data, we fetch historical prices for the selected tickers. Then,calculate_metricscomputes daily returns, mean returns, and the covariance matrix.get_dividend_yieldsretrieves the dividend yields for each ticker.Fetch Benchmark Data: We download historical data for the S&P 500 index (

^GSPC) to serve as our benchmark for performance comparison.Optimization and Rebalancing: Depending on the rebalancing setting, we either rebalance the portfolio periodically using

rebalance_portfolioor optimize it once withoptimize_portfolio.Convert Weights to JSON: The final portfolio weights are converted to a JSON format for better readability and further use.

Calculate Cumulative Returns: We compute cumulative returns for the optimized portfolio, the S&P 500, and an equally weighted portfolio with

calculate_cumulative_returns.

# Define global variables for the objectives

maximize_return = True

minimize_risk = True

maximize_sharpe = False

maximize_diversification = True

minimize_cvar = False

minimize_transaction_costs = False

maximize_dividend_yield = True

maximize_sortino = False

maximize_upside_potential = False

minimize_beta = False

rebalance = True

rebalance_period = 6 # in months

# Main execution

tickers = ['AAPL', 'MSFT', 'GOOGL', 'AMZN', 'ASML']

start_date = '2015-01-01'

end_date = '2025-01-01'

# Download and calculate metrics

data = download_data(tickers, start_date, end_date)

returns, mean_returns, cov_matrix = calculate_metrics(data)

dividend_yields = get_dividend_yields(tickers)

# Benchmark data

benchmark_ticker = '^GSPC'

benchmark_data = download_data(benchmark_ticker, start_date, end_date)

benchmark_returns = benchmark_data.pct_change().dropna()

# Optimization and Rebalancing

if rebalance:

rebalanced_weights = rebalance_portfolio(data, tickers, rebalance_period)

final_weights = rebalanced_weights[-1][1]

else:

final_weights = optimize_portfolio(mean_returns, cov_matrix, dividend_yields, benchmark_returns)

# Convert weights to JSON

weights_json = json.dumps(dict(zip(tickers, final_weights)), indent=4)

print(weights_json)

# Calculate cumulative returns

portfolio_cumulative = calculate_cumulative_returns(returns, final_weights)

sp500_cumulative = (1 + benchmark_returns).cumprod()

equal_weights = np.ones(len(tickers)) / len(tickers)

equal_weighted_cumulative = calculate_cumulative_returns(returns, equal_weights)

# Plot results

plot_results(portfolio_cumulative, sp500_cumulative, equal_weighted_cumulative)

{

"AAPL": 0.22729428549853123,

"MSFT": 0.2663101158784816,

"GOOGL": 0.2388010280751279,

"AMZN": 0.09101806783984355,

"ASML": 0.1765765027080158

}

Figure. 1: Cumulative Profit Plot for a Multi-objective Portfolio Against an Equally Weighted Portfolio and the SP&500 Benchmark.

Also worth reading:

Optimize Portfolio Performance with Risk Parity Rebalancing

Optimizing Portfolios With Hierarchical Risk Parity

Newsletter