Experience the Future of Intelligent Investing Today

Back To Top

Experience the Future of Intelligent Investing Today

Neural Trade. One AI system. 1000s of real-time data points. Instant market intelligence.

State-of-the-art data science and AI power quant models, valuation, sentiment, and volatility analysis. Serious tools built for serious decisions.

Identify better entry and exit zones using real-time price patterns, sentiment, and statistical confidence.

No posts were found for provided query parameters.

No posts were found for provided query parameters.

Using Llama to analyze Earnings Transcripts, 10-Q Fillings and Quarterly Investor Presentations In this article, we explore the implementation of Meta’s Llama 3.1 for analyzing

Setting Volatility-Based Stop Losses with Optimized Paramaters While knowing when to enter a trade position matters, knowing when to exit if things go wrong is

Probability Of Price Changes Occurring Conditional On Initial Price Changes Conditional probability helps us understand the likelihood of an event occurring, given that another event

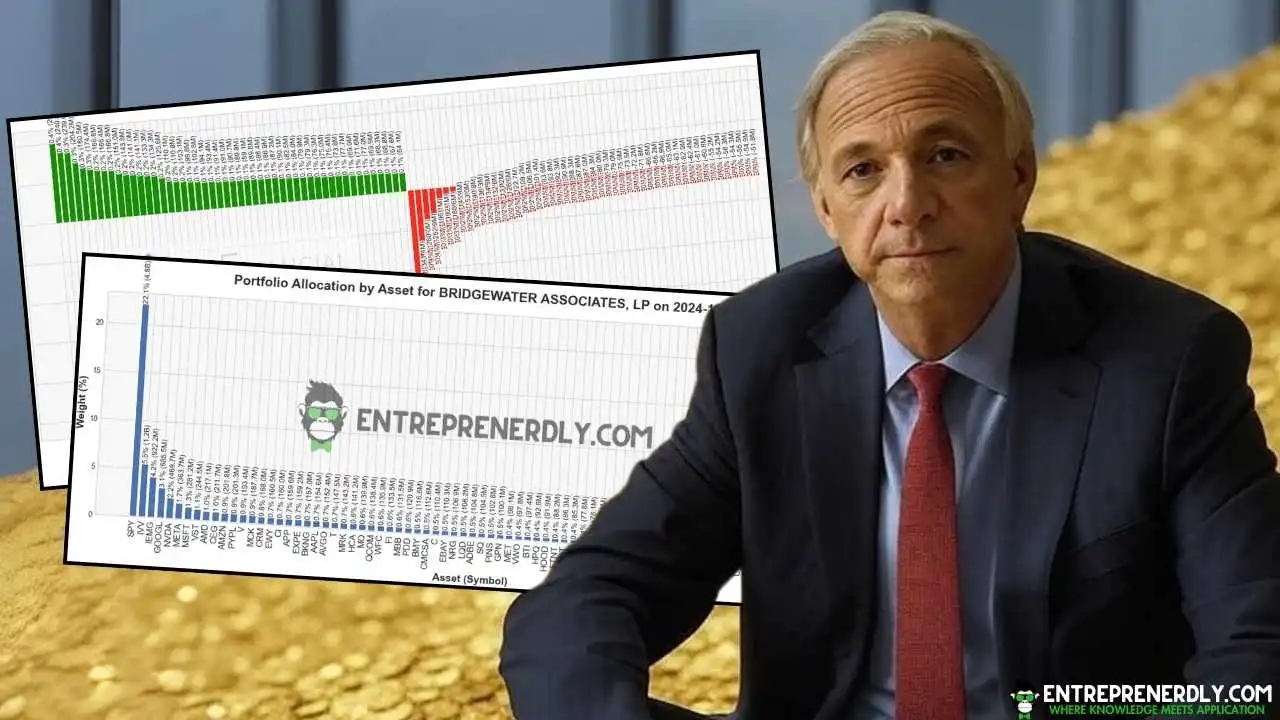

Portfolio optimization across multiple factors – Dividends, Returns, Volatility, CVaR, and more Multi-objective Portfolio optimization considers multiple objectives simultaneously, such as maximizing returns, minimizing risk,

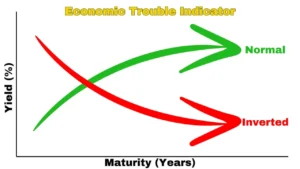

Yield Data Retrieval, Curve Interpretation, Spreads, Correlations, and Regime Shifts The yield curve, a plot of Treasury bond yields across different maturities, serves as a

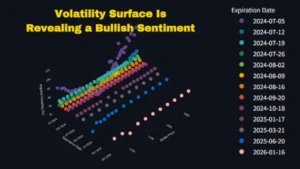

A Comprehensive Guide for Automating IV Analysis in Python Implied Volatility (IV) shows the market’s expectations of future price movements for an underlying asset. This

Identify and Trade Cointegrated Pairs Pairs trading is a market-neutral trading strategy that involves matching a long position with a short position in two assets

An Open State-of-the-Art Vision-Language Foundation Model Idefics2, the latest iteration, builds on the success of Idefics1 with enhanced Optical Character Recognition (OCR) abilities, improved architecture,