Experience the Future of Intelligent Investing Today

Back To Top

Experience the Future of Intelligent Investing Today

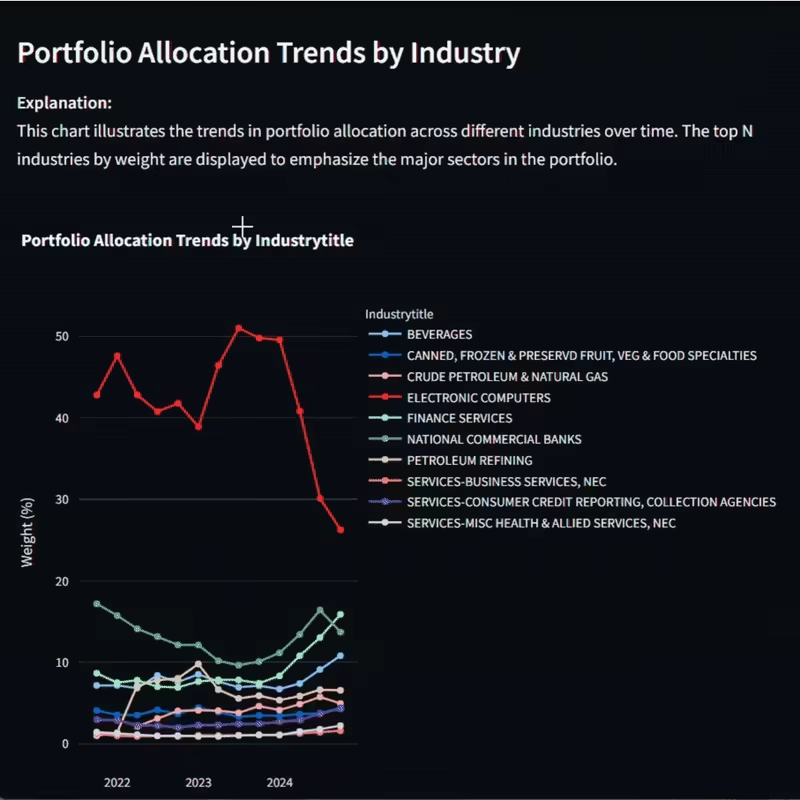

Bridgewater Associates, managing a $21.8 billion portfolio as of December 2024, has made decisive adjustments to its investment strategy.

The firm increased its stake in the SPDR S&P 500 ETF Trust by 19.4% and initiated a new position in Tesla.

It also reduced holdings in some tech companies and emerging markets to align with evolving market conditions.

Bridgewater now emphasizes financial services, select tech companies, and defensive sectors like pharmaceuticals.

The firm employs a 677-security strategy to diversify risk. These changes reflect regulatory shifts, AI sector volatility, and a focus on liquidity.

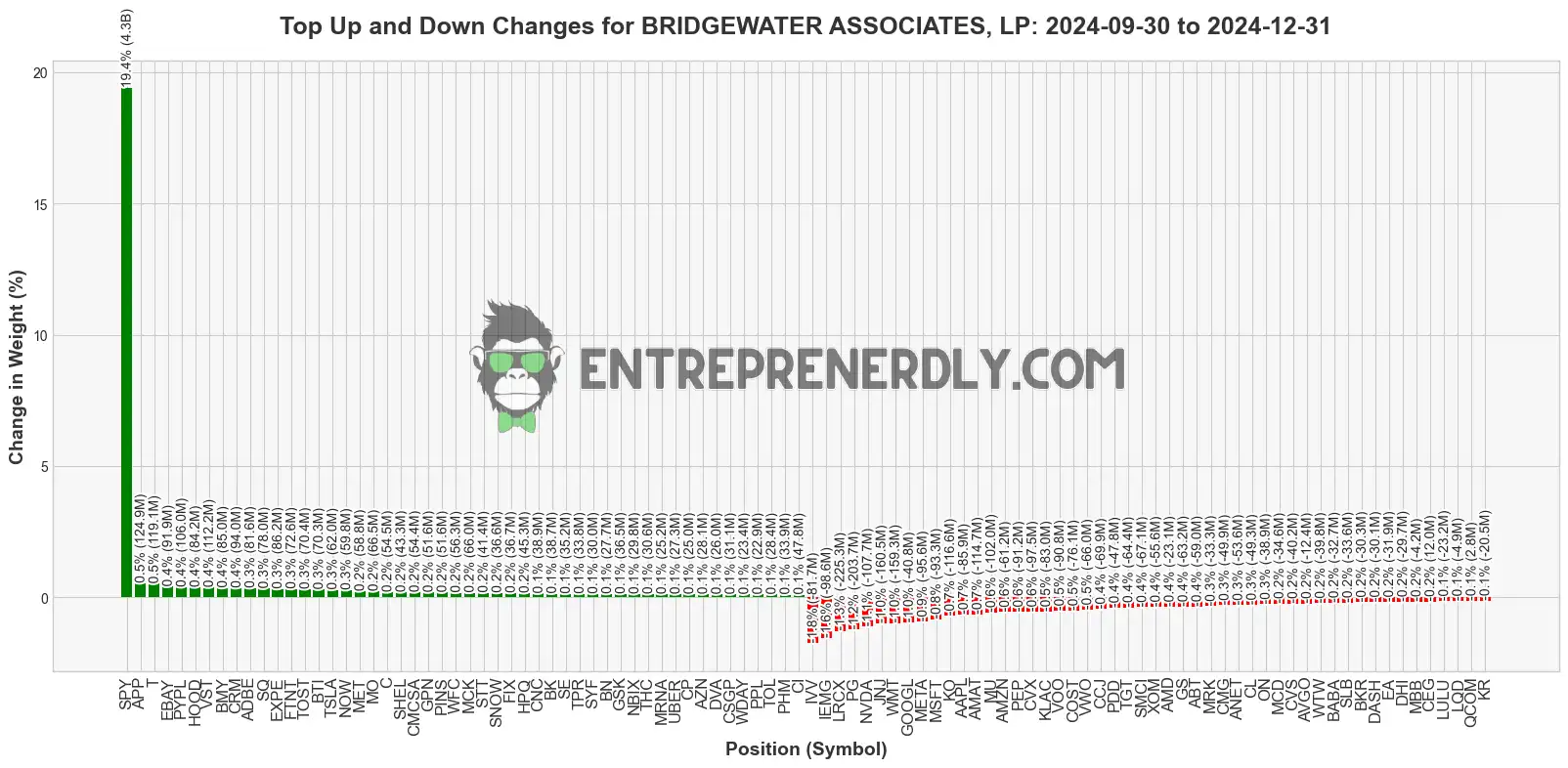

Figure 1: Top Position Changes (From September 30, 2024, to December 31, 2024) - The biggest increases and decreases in Bridgewater Associates' portfolio over the last quarter.

Bridgewater made an aggressive move into SPY, increasing its allocation by 19.4% to add $4.3 billion to its position.

This suggests confidence in U.S. market resilience amid post-election policy shifts and economic stability concerns.

Bridgewater took a new position in Tesla, worth $62 million. This move suggests the firm is capitalizing on AI-driven auto advancements and Musk’s influence in Washington

Bridgewater increased stakes in PayPal and AppLovin, betting on AI-driven digital finance and advertising. These sectors continue to show recession-resistant revenue growth.

AT&T’s 6.7% dividend yield and $24 billion fiber expansion plan made it an attractive defensive investment.

This aligns with Bridgewater’s strategy of prioritizing high-yield, stable cash flow assets.

Use Entreprenerdly’s Institutional Portfolio Allocation Activity to stay up to date with the latest Institutional Portfolio Movements.

Newsletter