Experience the Future of Intelligent Investing Today

Back To Top

Experience the Future of Intelligent Investing Today

Pershing Square Capital Management’s portfolio is in flux. With $12.6 billion in assets, Bill Ackman’s fund is repositioning for market turbulence.

Recent filings show significant increases in Brookfield Corp and Alphabet. Meanwhile, he’s cutting back on Hilton Worldwide and Chipotle Mexican Grill.

It’s not just rebalancing — it’s a strategic shift. Let’s break down these changes and see what they mean for Pershing Square’s future.

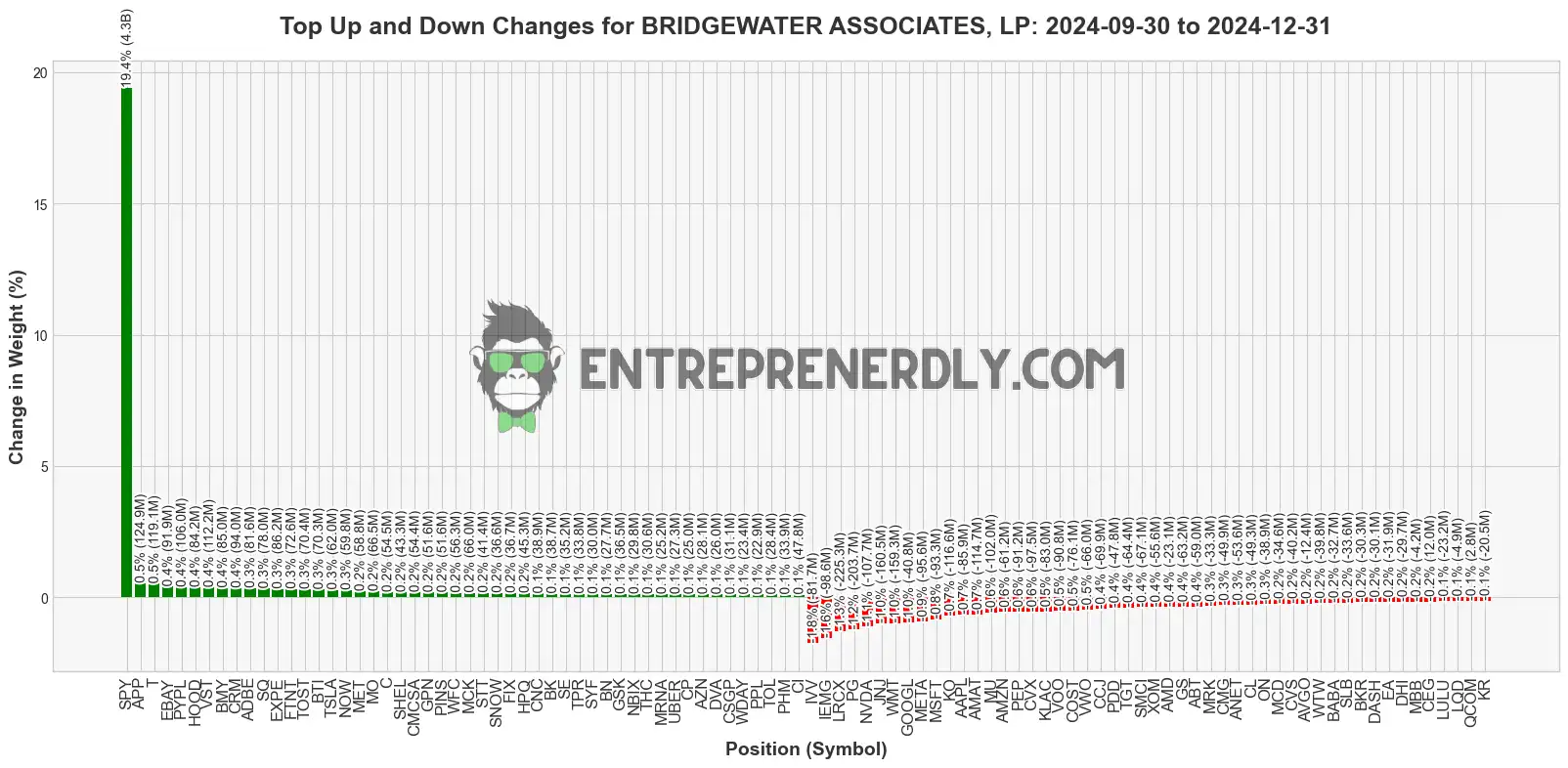

Figure 1: Top Position Changes (From September 30, 2024, to December 31, 2024) - The biggest increases and decreases in Pershing Square's portfolio over the last quarter.

Ackman increased Brookfield Corp’s position to 15.9% of the portfolio, adding $264.7 million. BN is surging, up nearly 30%, now trading at $61.31.

Brookfield is a major player in real estate and renewable energy. The company benefits from rising infrastructure demand and the upcoming public listing of its private BAM stake.

Alphabet now represents 17.4% of Pershing Square’s portfolio. Ackman added $175.5 million to GOOG to reinforce his bet on AI and digital transformation.

Google remains stable amid market volatility. Google Cloud and AI investments position Alphabet as both a growth driver and a hedge against broader tech risks.

Hilton Worldwide Holdings now makes up 10.7% of the fund, but Ackman cut his stake by $354.1 million (2.5%).

Why? Slowing business travel, rising labor costs, and inflated valuations. At $268.87 per share, Hilton remains strong, but Ackman sees better opportunities elsewhere.

Chipotle dropped by 1.1% in portfolio weight, a reduction of $173.7 million.

Despite a strong brand, CMG faces headwinds. Wage inflation and slowing same-store sales make it less attractive in the short term.

Ackman’s move suggests he’s shifting toward sectors with clearer near-term upside.

Use Entreprenerdly’s Institutional Portfolio Allocation Activity to stay up to date with the latest Institutional Portfolio Movements.

Newsletter