15 Time-varying Techniques for Proactive Risk Analytics in Python [Part 2/2]

Building on the foundational principles of dynamic risk management discussed in our prior article, we now discuss specific techniques that address both the peaks and valleys of financial risk. While the first segment centered on broader risk metrics and their foundational implications, this continuation brings to light tools specifically tailored to measure extremities, stability, and investor sentiments in financial markets. As a refresher, here’s the complete list of the 15 dynamic risk management techniques we’re exploring across this two-part series:

- Historical Volatility

- Sharpe Ratio

- Treynor Ratio

- Rolling Beta

- Jensen’s Alpha

- Value at Risk

- Conditional Value at Risk

- Tail Ratio

- Omega Ratio

- Sortino Ratio

- Calmar Ratio

- Stability of Returns

- Maximum Drawdown

- Upside Capture and Downside Capture

- Pain Index

This is the continuation of our discussion on dynamic risk management, covering the last eight techniques. If you’re new to this series, you might find it useful to start with the first part where the initial seven methods are introduced.

Dynamic Risk Management Using Rolling Stock Price Metrics

2. Dynamic Risk Management in Python

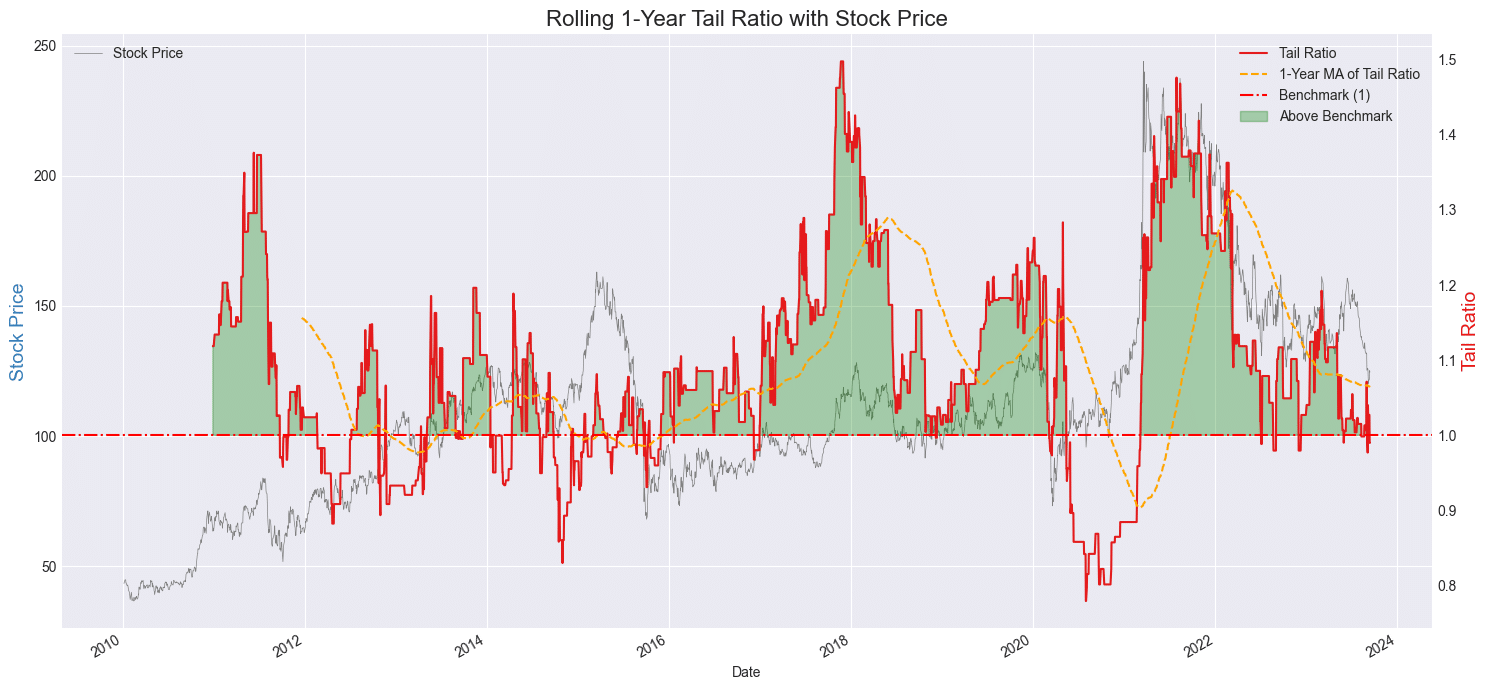

2.1 Tail Ratio

The Tail Ratio provides an understanding of the relative extremity of positive and negative returns for an asset. Essentially, it offers a metric to evaluate the potential for upside against the downside risk. A tail ratio greater than 1 indicates that the asset’s potential for extreme positive returns (at the 95th percentile) is greater than its potential for extreme negative returns (at the 5th percentile). Conversely, a tail ratio below 1 suggests the opposite.

Equation. 1: Tail Ratio: A metric assessing the relative risk of negative returns (at the 5th percentile) to positive outcomes (at the 95th percentile), helping to gauge the distribution’s tail risk.

The Tail Ratio is particularly useful as it helps investors gauge how skewed an asset’s returns might be towards positive or negative extremes. For investors, periods where the Tail Ratio consistently exceeds 1 might be of interest as they hint at an asset’s potential for skewed positive returns without correspondingly extreme negative returns.

import pandas as pd

import numpy as np

import yfinance as yf

import matplotlib.pyplot as plt

tickerSymbol = "VOW.DE"

tickerData = yf.Ticker(tickerSymbol)

tickerDf = tickerData.history(period='1d', start='2010-1-1')

tickerDf['returns'] = tickerDf['Close'].pct_change()

tail_ratio = tickerDf['returns'].rolling(252).apply(lambda x: np.abs(np.percentile(x, 95)) / np.abs(np.percentile(x, 5))).dropna()

# Aesthetics

plt.figure(figsize=(15,7))

plt.style.use('seaborn-darkgrid')

palette = plt.get_cmap('Set1')

# Plot stock price

ax1 = plt.gca()

tickerDf['Close'].plot(ax=ax1, color='gray', linewidth=0.5, label='Stock Price')

ax1.set_ylabel('Stock Price', fontsize=14, color=palette(1))

ax1.legend(loc='upper left')

# Plot tail ratio

ax2 = ax1.twinx()

ax2.plot(tail_ratio.index, tail_ratio, color=palette(0), linewidth=1.5, label='Tail Ratio')

# Plotting a simple moving average of the tail ratio

ax2.plot(tail_ratio.index, tail_ratio.rolling(window=252).mean(), color='orange', linestyle='--', label='1-Year MA of Tail Ratio')

# Horizontal line for benchmark tail ratio of 1

ax2.axhline(y=1, color='red', linestyle='-.', label='Benchmark (1)')

# Shade region where tail ratio is above 1

ax2.fill_between(tail_ratio.index, tail_ratio, 1, where=(tail_ratio > 1), color='green', alpha=0.3, label='Above Benchmark')

# Aesthetics for the tail ratio plot

ax2.set_ylabel('Tail Ratio', fontsize=14, color=palette(0))

ax2.legend(loc='upper right')

plt.title('Rolling 1-Year Tail Ratio with Stock Price', fontsize=16)

ax2.grid(False) # Turn off grid for the second axis

plt.tight_layout()

plt.show()

Figure. 1: Rolling 1-Year Tail Ratio for “VOW.DE” with its stock price in the background. The green-shaded region indicates periods when extreme positive returns outweighed negative ones, while the orange dashed line provides a smoothed, averaged view of the Tail Ratio over the same time frame.

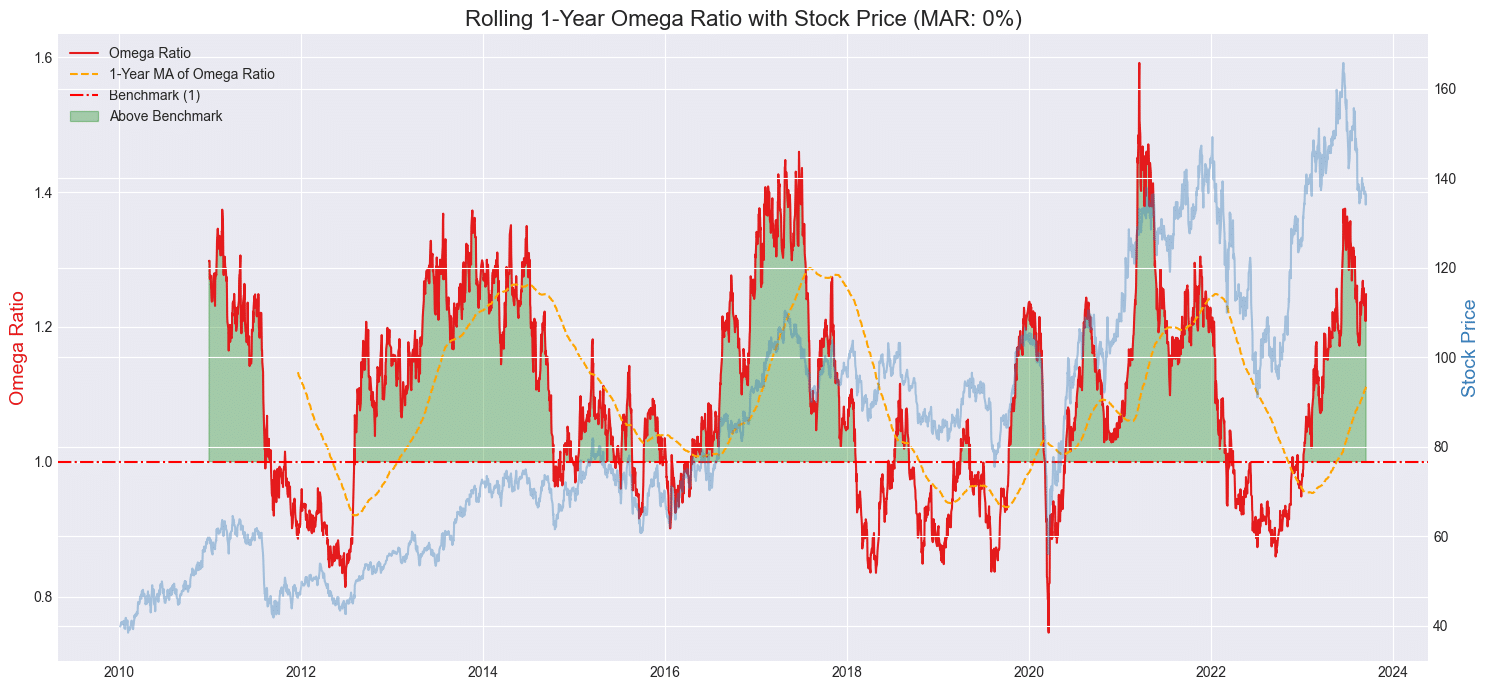

2.2 Omega Ratio

The Omega Ratio is a popular performance measure used to evaluate the return of an investment relative to its risk. It gauges the potential reward received for the risk taken, with respect to a given benchmark or Minimum Acceptable Return (MAR). Essentially, it divides the upside potential (returns above MAR) by the downside risk (returns below MAR).

Equation. 2: Omega Ratio: A measure of risk-adjusted performance that takes into account the returns above and below a minimum acceptable return (MAR).

If the Omega Ratio is greater than 1, it indicates the investment’s return surpasses the MAR for each unit of downside risk taken. Conversely, an Omega Ratio below 1 suggests the returns do not justify the associated downside risk.

import pandas as pd

import numpy as np

import yfinance as yf

import matplotlib.pyplot as plt

tickerSymbol = "SIE.DE"

tickerData = yf.Ticker(tickerSymbol)

tickerDf = tickerData.history(period='1d', start='2010-1-1')

tickerDf['returns'] = tickerDf['Close'].pct_change()

MAR = 0 # Minimum Acceptable Return

omega_ratio = tickerDf['returns'].rolling(252).apply(lambda x: np.sum(x[x > MAR] - MAR) / np.sum(MAR - x[x < MAR])).dropna()

# Aesthetics

plt.figure(figsize=(15,7))

plt.style.use('seaborn-darkgrid')

palette = plt.get_cmap('Set1')

# Plot Omega Ratio

ax1 = plt.gca()

ax1.plot(omega_ratio.index, omega_ratio, color=palette(0), linewidth=1.5, label='Omega Ratio')

# Plotting a simple moving average of the omega ratio

ax1.plot(omega_ratio.index, omega_ratio.rolling(window=252).mean(), color='orange', linestyle='--', label='1-Year MA of Omega Ratio')

# Horizontal line for benchmark Omega Ratio of 1

ax1.axhline(y=1, color='red', linestyle='-.', label='Benchmark (1)')

# Shade region where Omega Ratio is above 1

ax1.fill_between(omega_ratio.index, omega_ratio, 1, where=(omega_ratio > 1), color='green', alpha=0.3, label='Above Benchmark')

# Aesthetics for Omega Ratio

ax1.set_ylabel('Omega Ratio', fontsize=14, color=palette(0))

ax1.legend(loc='upper left')

ax1.set_title(f'Rolling 1-Year Omega Ratio with Stock Price (MAR: {MAR*100}%)', fontsize=16)

# Stock Price Plot on secondary y-axis

ax2 = ax1.twinx()

ax2.plot(tickerDf.index, tickerDf['Close'], color=palette(1), alpha=0.4, label='Stock Price')

ax2.set_ylabel('Stock Price', fontsize=14, color=palette(1))

plt.tight_layout()

plt.show()

Figure. 2: Rolling 1-Year Omega Ratio for “SIE.DE”, with a Minimum Acceptable Return (MAR) set at 0%. The green-shaded region signifies periods when the investment return justified the risk undertaken, relative to the MAR. An accompanying one-year moving average (orange dashed line) offers a smoothed perspective on the Omega Ratio’s movement over time.

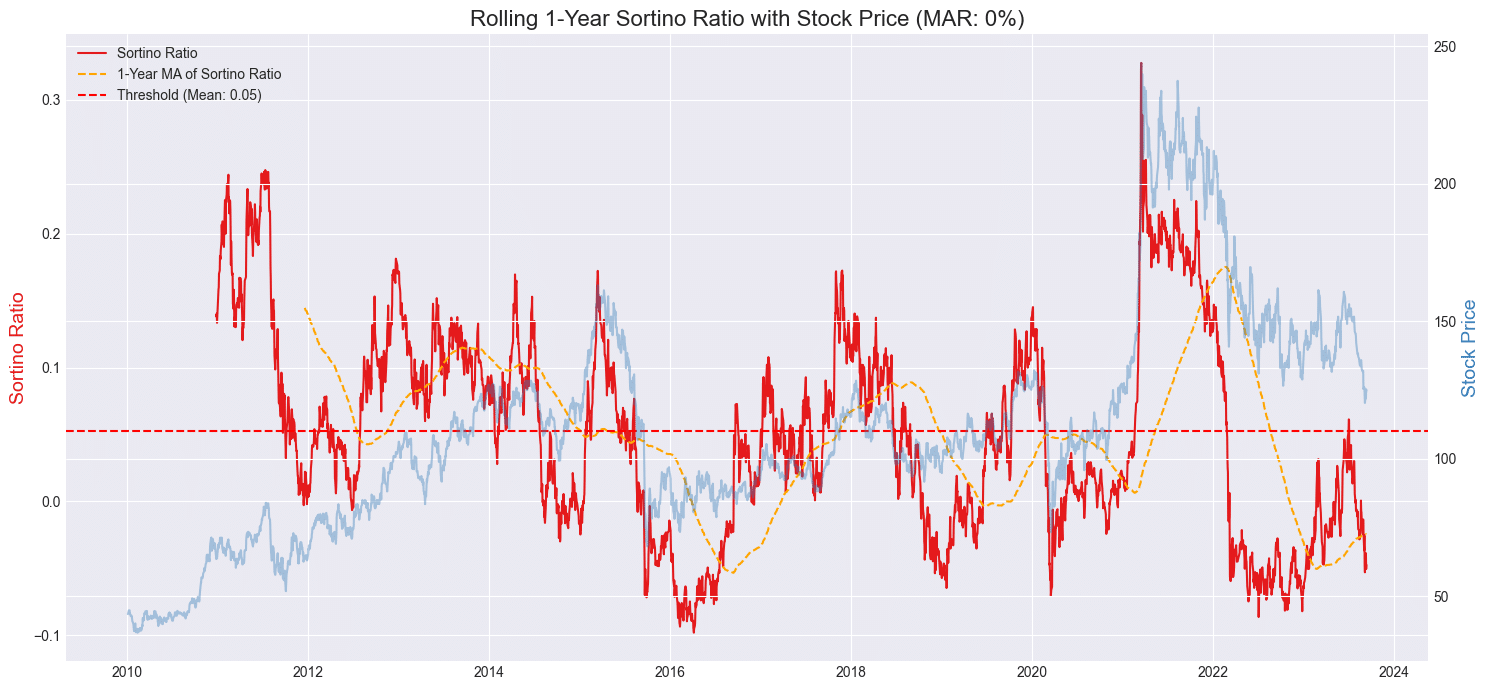

2.3 Sortino Ratio

The Sortino Ratio is a variation of the Sharpe Ratio that only factors in the downside risk or the negative volatility. Instead of assessing total volatility as a measure of risk (like the Sharpe Ratio), the Sortino Ratio focuses solely on the unwanted variability, or the risk of achieving returns below a desired threshold — typically known as the Minimum Acceptable Return (MAR). This offers a more tailored evaluation of risk by only considering the negative outcomes.

Equation. 3: Sortino Ratio: A performance metric used to measure the risk-adjusted return of an investment asset, taking into account the downside risk relative to a minimum acceptable return (MAR).

Where:

- R = Average realized return

- T = Target or required rate of return (MAR in this context)

- DR = Downside risk (standard deviation of the negative asset returns relative to MAR)

Generally, a higher Sortino Ratio indicates a better risk-adjusted performance. However, a value below the mean suggests that the returns might not sufficiently compensate for the downside risk relative to the MAR.

import pandas as pd

import numpy as np

import yfinance as yf

import matplotlib.pyplot as plt

# Fetch Data

tickerSymbol = "VOW.DE"

tickerData = yf.Ticker(tickerSymbol)

tickerDf = tickerData.history(period='1d', start='2010-1-1')

tickerDf['returns'] = tickerDf['Close'].pct_change()

MAR = 0 # Minimum Acceptable Return

sortino_ratio = tickerDf['returns'].rolling(252).apply(lambda x: np.mean(x - MAR) / np.sqrt(np.mean(np.minimum(0, x - MAR) ** 2))).dropna()

threshold = sortino_ratio.mean()

# Aesthetics

plt.figure(figsize=(15,7))

plt.style.use('seaborn-darkgrid')

palette = plt.get_cmap('Set1')

# Plot Sortino Ratio

ax1 = plt.gca()

ax1.plot(sortino_ratio.index, sortino_ratio, color=palette(0), linewidth=1.5, label='Sortino Ratio')

# Smoothened Sortino Ratio with a moving average

ax1.plot(sortino_ratio.index, sortino_ratio.rolling(window=252).mean(), color='orange', linestyle='--', label='1-Year MA of Sortino Ratio')

ax1.axhline(y=threshold, color='red', linestyle='--', label=f'Threshold (Mean: {threshold:.2f})')

# Aesthetics for Sortino Ratio

ax1.set_ylabel('Sortino Ratio', fontsize=14, color=palette(0))

ax1.legend(loc='upper left')

ax1.set_title(f'Rolling 1-Year Sortino Ratio with Stock Price (MAR: {MAR*100}%)', fontsize=16)

# Stock Price Plot on secondary y-axis

ax2 = ax1.twinx()

ax2.plot(tickerDf.index, tickerDf['Close'], color=palette(1), alpha=0.4, label='Stock Price')

ax2.set_ylabel('Stock Price', fontsize=14, color=palette(1))

plt.tight_layout()

plt.show()

Figure. 3: Rolling 1-Year Sortino Ratio for “VOW.DE”, with a Minimum Acceptable Return (MAR) set at 0%. The graph contrasts the real-time Sortino Ratio against its one-year moving average and mean, shedding light on the stock’s risk-adjusted performance with respect to unwanted downside variability.

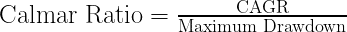

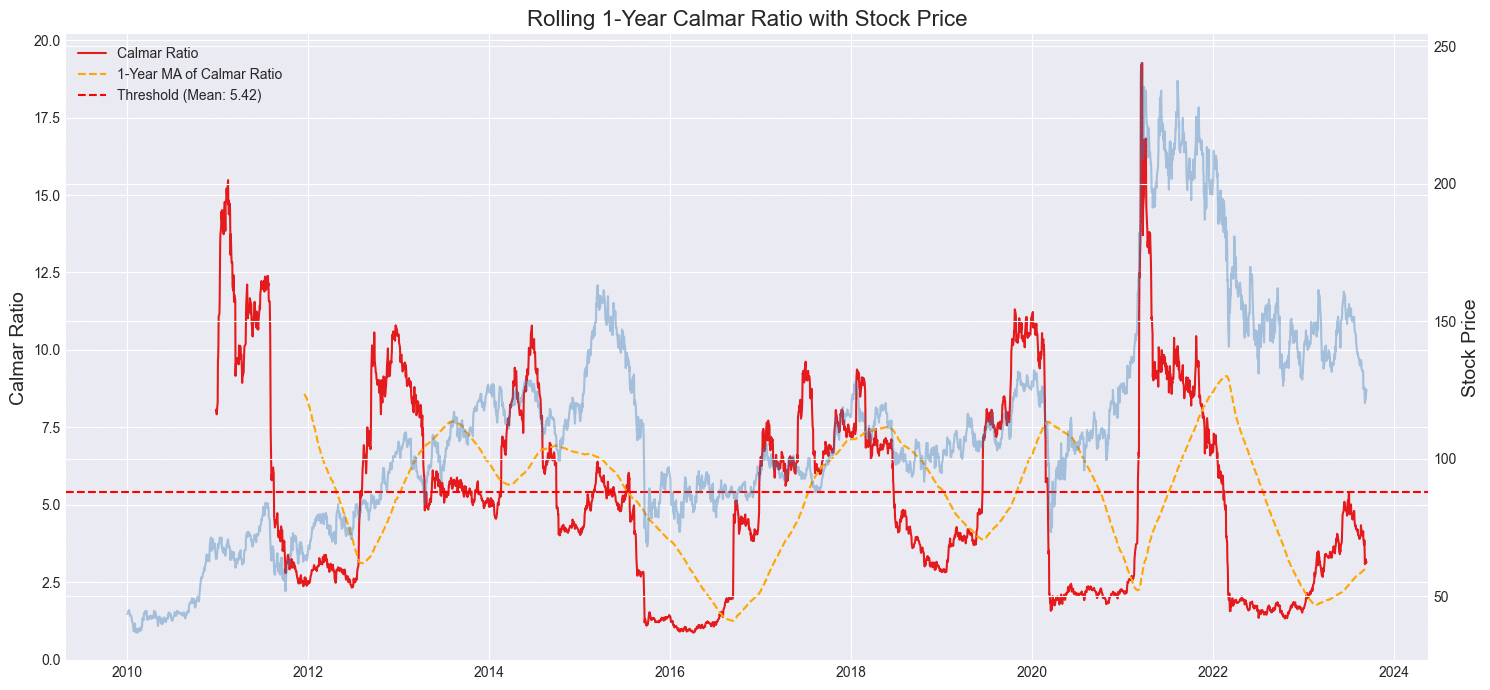

2.4 Calmar Ratio

The Calmar Ratio, also known as the drawdown ratio, is a performance metric used to assess the risk-adjusted performance of investment portfolios. The ratio measures the relationship between the portfolio’s compound annual growth rate (CAGR) and its maximum drawdown, offering insights into the potential return of an investment relative to its risk.

Equation. 4: Calmar Ratio: A performance measurement that calculates the risk-adjusted return of an investment asset using the ratio of the Compound Annual Growth Rate to the maximum drawdown.

Where:

- CAGR (Compound Annual Growth Rate) represents the geometric progression ratio that provides a smooth annual rate, shaping the portfolio’s returns over time.

- Maximum Drawdown depicts the largest peak-to-valley decline of the investment’s value, indicating the maximum observed loss from a peak over a specified period.

A higher Calmar Ratio is generally preferred, suggesting that the potential return of the investment might justify the associated risk. However, a ratio below the average threshold could imply that the returns do not adequately compensate for the observed drawdown risk.

import pandas as pd

import numpy as np

import yfinance as yf

import matplotlib.pyplot as plt

tickerSymbol = "VOW.DE"

tickerData = yf.Ticker(tickerSymbol)

tickerDf = tickerData.history(period='1d', start='2010-1-1')

tickerDf['returns'] = tickerDf['Close'].pct_change()

calmar_ratio = tickerDf['returns'].rolling(252).apply(lambda x: (1 + x).cumprod()[-1] ** (252.0 / len(x)) / np.abs(np.min((1 + x).cumprod() / (1 + x).cumprod().cummax()) - 1)).dropna()

threshold_calmar = calmar_ratio.mean()

plt.figure(figsize=(15,7))

plt.style.use('seaborn-darkgrid')

palette = plt.get_cmap('Set1')

ax1 = plt.gca()

ax1.plot(calmar_ratio.index, calmar_ratio, color=palette(0), linewidth=1.5, label='Calmar Ratio')

ax1.plot(calmar_ratio.index, calmar_ratio.rolling(window=252).mean(), color='orange', linestyle='--', label='1-Year MA of Calmar Ratio')

ax1.axhline(y=threshold_calmar, color='red', linestyle='--', label=f'Threshold (Mean: {threshold_calmar:.2f})')

ax1.set_title('Rolling 1-Year Calmar Ratio with Stock Price', fontsize=16)

ax1.set_ylabel('Calmar Ratio', fontsize=14)

ax1.legend(loc='upper left')

ax2 = ax1.twinx()

ax2.plot(tickerDf.index, tickerDf['Close'], color=palette(1), alpha=0.4, label='Stock Price')

ax2.set_ylabel('Stock Price', fontsize=14)

plt.tight_layout()

plt.show()

Figure. 4: Rolling 1-Year Calmar Ratio for “VOW.DE”, contrasting the real-time Calmar Ratio against its one-year moving average and mean. The visualization offers insights into the stock’s potential return in relation to its observed risk.

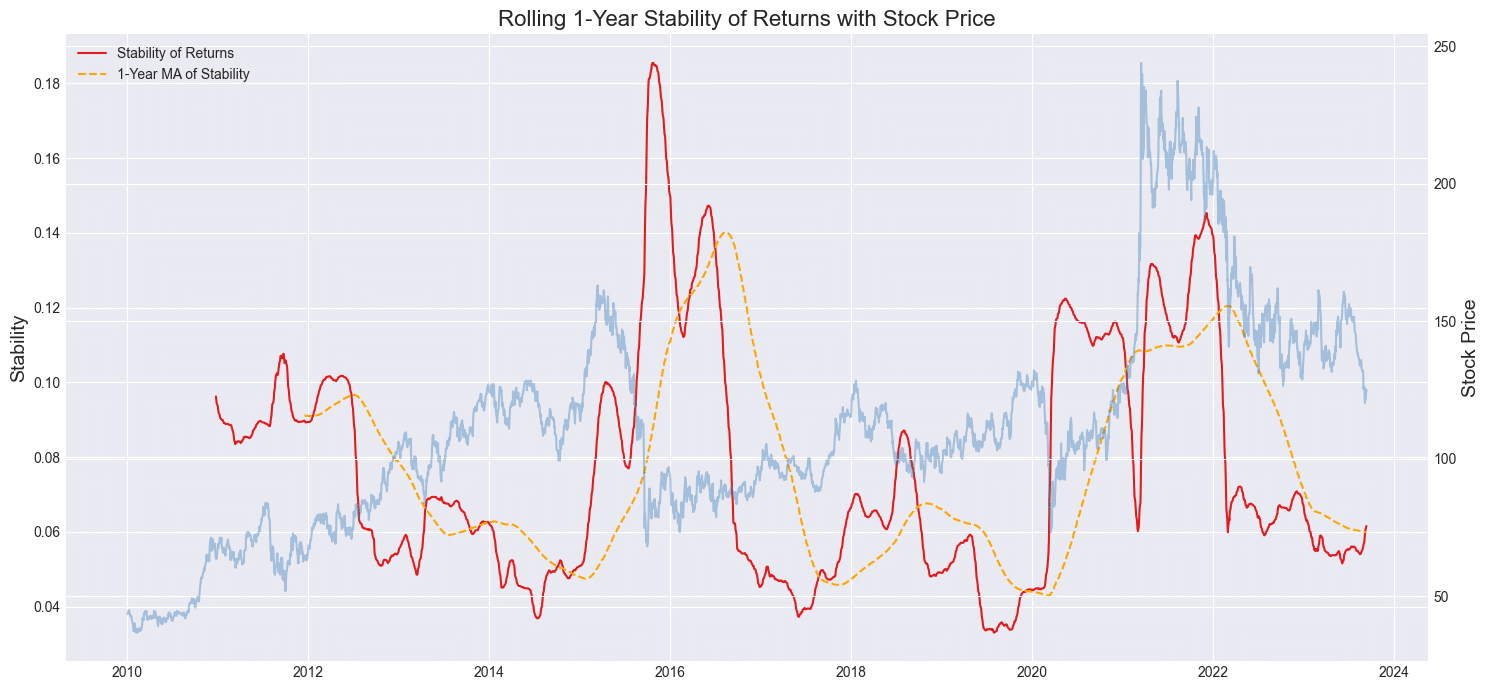

2.5 Returns Stability

Stability of returns is a valuable metric for investors as it provides insight into the consistency and predictability of a portfolio’s returns over time. Essentially, it captures the deviation of the portfolio’s returns from a linear trend, indicating how much the returns have deviated from a linear growth trajectory. The stability is calculated by comparing the cumulative logarithmic returns of the portfolio against the expected cumulative returns derived from a linear regression trend.

Equation. 5: Returns Stability: A measure of how consistent an investment’s returns are over time, calculated by comparing the cumulative log returns of the investment to the expected cumulative returns based on a linear trend.

Where:

- Cumulative Log Returns are the running total of log-transformed returns. Expected Cumulative Returns from Linear TrendExpected Cumulative Returns from Linear Trend are obtained by fitting a linear regression on the cumulative log returns.

A lower stability value is typically desirable, indicating that the portfolio’s returns closely follow a predictable, linear trend. Conversely, higher values signify more unpredictable returns that deviate considerably from a linear growth path.

from scipy.stats import linregress

tickerSymbol = "VOW.DE"

tickerData = yf.Ticker(tickerSymbol)

tickerDf = tickerData.history(period='1d', start='2010-1-1')

tickerDf['returns'] = tickerDf['Close'].pct_change()

stability = tickerDf['returns'].rolling(252).apply(lambda x: np.std(np.log1p(x).cumsum() - linregress(np.arange(len(x)), np.log1p(x).cumsum()).intercept - linregress(np.arange(len(x)), np.log1p(x).cumsum()).slope * np.arange(len(x)))).dropna()

plt.figure(figsize=(15,7))

plt.style.use('seaborn-darkgrid')

ax1 = plt.gca()

ax1.plot(stability.index, stability, color=palette(0), linewidth=1.5, label='Stability of Returns')

ax1.plot(stability.index, stability.rolling(window=252).mean(), color='orange', linestyle='--', label='1-Year MA of Stability')

ax1.set_title('Rolling 1-Year Stability of Returns with Stock Price', fontsize=16)

ax1.set_ylabel('Stability', fontsize=14)

ax1.legend(loc='upper left')

ax2 = ax1.twinx()

ax2.plot(tickerDf.index, tickerDf['Close'], color=palette(1), alpha=0.4, label='Stock Price')

ax2.set_ylabel('Stock Price', fontsize=14)

plt.tight_layout()

plt.show()

Figure. 5: Rolling 1-Year Stability of Returns for “VOW.DE”, juxtaposing the real-time stability against its one-year moving average. The chart sheds light on the consistency and predictability of the stock’s returns over time.

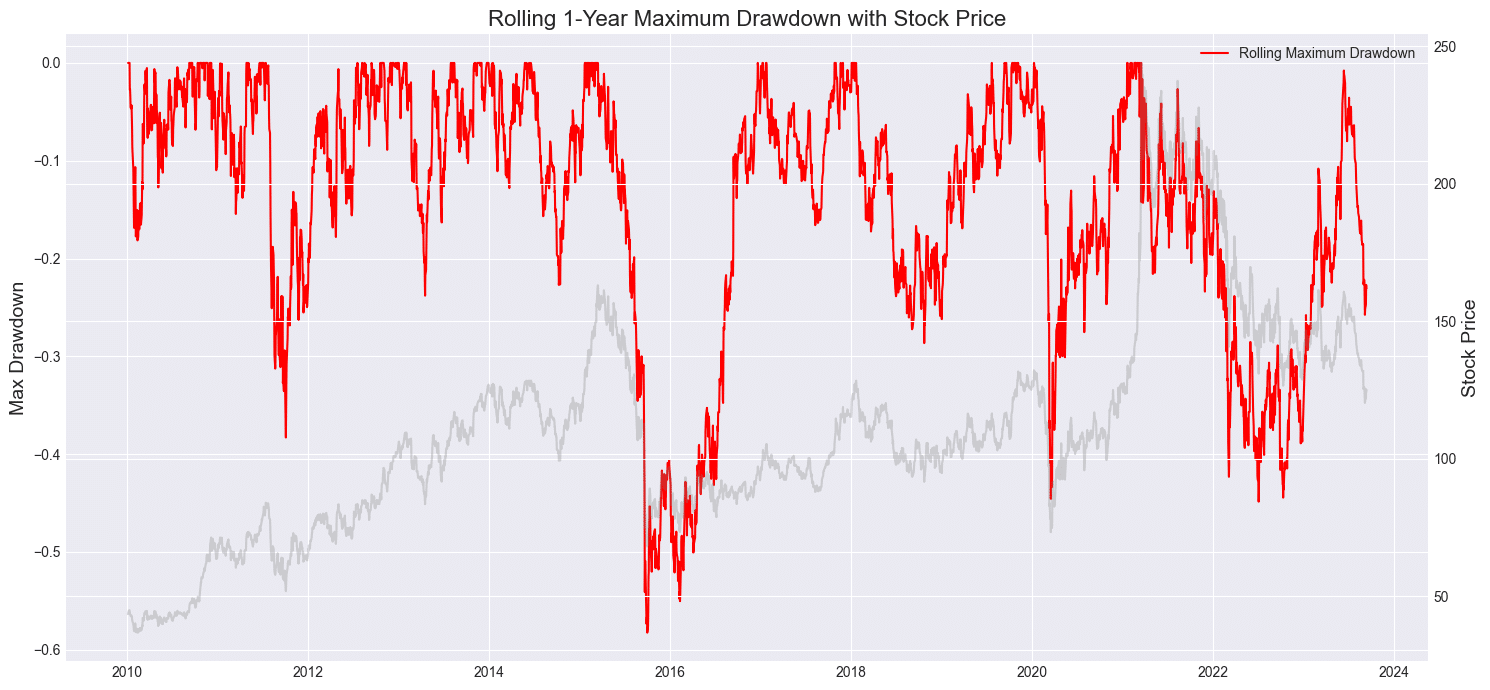

2.6 Maximum Drawdown

The maximum drawdown (MDD) is a risk metric that measures the largest single drop from peak to bottom in the value of a portfolio. In other words, it quantifies the maximum loss an investor could have experienced if they bought at the highest point before a downturn and sold at the subsequent trough. MDD is a significant indicator because it gives investors an idea of the worst-case scenario for a given investment, as seen historically.

Equation. 6: Maximum Drawdown (MDD): A measure of the largest single drop from peak to trough in the value of a portfolio, indicating the highest potential loss and the risk of the chosen strategy.

Where:

- Cumulative Minimum Value refers to the lowest value of the cumulative returns after the Cumulative Maximum Value within the rolling period.

- Cumulative Maximum Value is the highest cumulative return value achieved before the drawdown starts.

The visual representation below portrays the maximum drawdown across time, with more pronounced dips in the red line highlighting the periods when the stock witnessed significant declines from its previous highs.

import pandas as pd

import numpy as np

import yfinance as yf

import matplotlib.pyplot as plt

tickerSymbol = "VOW.DE"

tickerData = yf.Ticker(tickerSymbol)

tickerDf = tickerData.history(period='1d', start='2010-1-1')

tickerDf['returns'] = tickerDf['Close'].pct_change()

rolling_cumulative = (1 + tickerDf['returns']).cumprod()

rolling_max = rolling_cumulative.rolling(252, min_periods=1).max()

rolling_drawdown = (rolling_cumulative - rolling_max) / rolling_max

plt.figure(figsize=(15,7))

ax1 = plt.gca()

ax1.plot(rolling_drawdown, label='Rolling Maximum Drawdown', linewidth=1.5, color='red')

ax1.set_title('Rolling 1-Year Maximum Drawdown with Stock Price', fontsize=16)

ax1.set_ylabel('Max Drawdown', fontsize=14)

ax1.legend()

ax2 = ax1.twinx()

ax2.plot(tickerDf['Close'], color='grey', alpha=0.3, label='Stock Price')

ax2.set_ylabel('Stock Price', fontsize=14)

plt.tight_layout()

plt.show()

Figure. 6: Rolling 1-Year Maximum Drawdown for “VOW.DE” against its stock price. The chart showcases periods of significant downturns from previous highs, offering a historical perspective on the stock’s worst-case scenarios.

2.7 Upside Capture and Downside Capture

Capture ratios are useful metrics for understanding how an investment performs relative to a benchmark, especially during up and down market movements. The Upside Capture Ratio shows how well an investment outperforms a benchmark during periods when the benchmark has positive returns. Conversely, the Downside Capture Ratio indicates how the investment performs compared to the benchmark during times when the benchmark has negative returns.

Equation. 7: Upside Capture Ratio: A measure of a portfolio’s performance in up markets relative to a benchmark. A ratio above 100 indicates the portfolio has outperformed the benchmark during positive market conditions.

Equation. 8: Downside Capture Ratio: A measure of a portfolio’s performance in down markets relative to a benchmark. A ratio above 100 indicates the portfolio has lost more than the benchmark during negative market conditions.

The resulting chart below provides a dual representation:

- Rolling Upside Capture: The line indicates how well the stock has outperformed the S&P 500 during periods when the S&P 500 was increasing. Values above 100% signify outperformance relative to the benchmark during positive market movements.

- Rolling Downside Capture: This line illustrates how the stock performed relative to the S&P 500 during times when the S&P 500 was declining. Values below 100% are desirable here, as they indicate that the stock fell less than the benchmark during negative market movements.

Newsletter