Where Models Break Down, What Algorithms Don’t See, The Human Advantage, and Instinct in Action

Traders worship algorithms, and rightfully so. Algorithms have reshaped financial markets.

Today, most trades are executed at machine speed and are guided by mathematical models and data-driven logic.

Yet, history shows that there are moments when trusting your gut can be as valuable as the sharpest model.

Especially with years of market experience (Schwager, 1989) and when things are not entirely mechanical.

Models excel in stable environments where they can handle large amounts of information with consistency.

But every major dislocation, from Black Monday to the subprime crisis to the pandemic crash, shows limits that no model can overcome (Lo, 2017).

The edge comes not from rejecting algorithms, but from understanding their boundaries and knowing when to pair it with qualitative judgment:

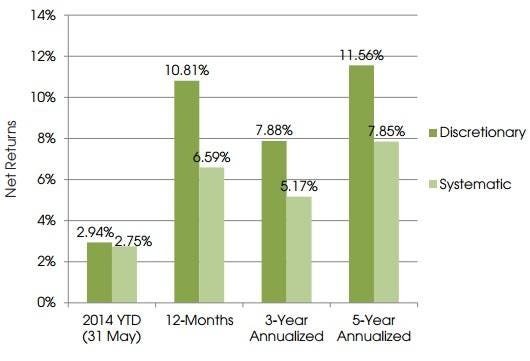

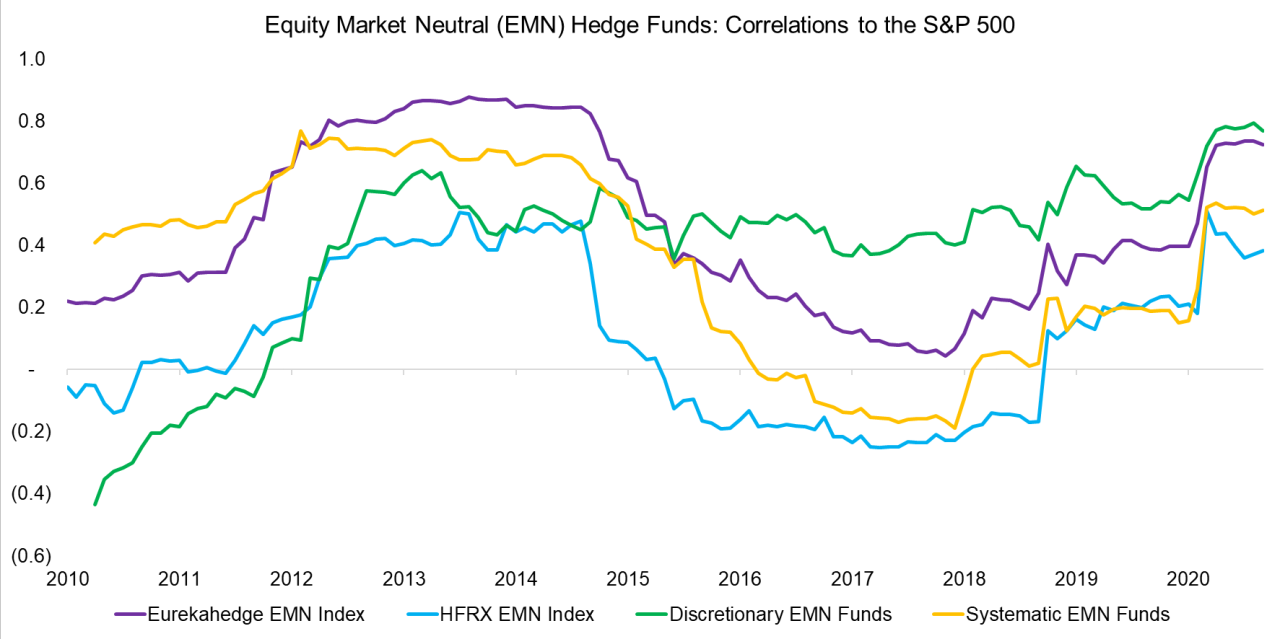

Figure 1. Discretionary hedge funds, i.e. those run by real people making calls, have outperformed systematic, model-driven funds across every major time frame in recent years. Source: IvyPanda.

Here, we’ll discuss:

- Limitations of Models and What They Don’t See

- The Human Advantage: What Data Can’t Capture

- Instinct in Action: Legendary Market Calls

- How to Know When to Trust Your Gut

- Intuition Is Your Long-Run Edge

Where Models Break Down and What they Don’t See

Historical data cannot predict unprecedented events.

Historical data only goes so far. Most models perform well until something new happens. Something outside their experience (Chan, 2013).

Unprecedented events are, by definition, not in the backtest. This is why major dislocations, from the 1987 crash to the COVID-19 market plunge, have repeatedly exposed the limits of even the best systems.

Models underestimate feedback loops and crowded trades.

Models have trouble with feedback loops and crowded trades. When many strategies use similar signals, the exits can get jammed.

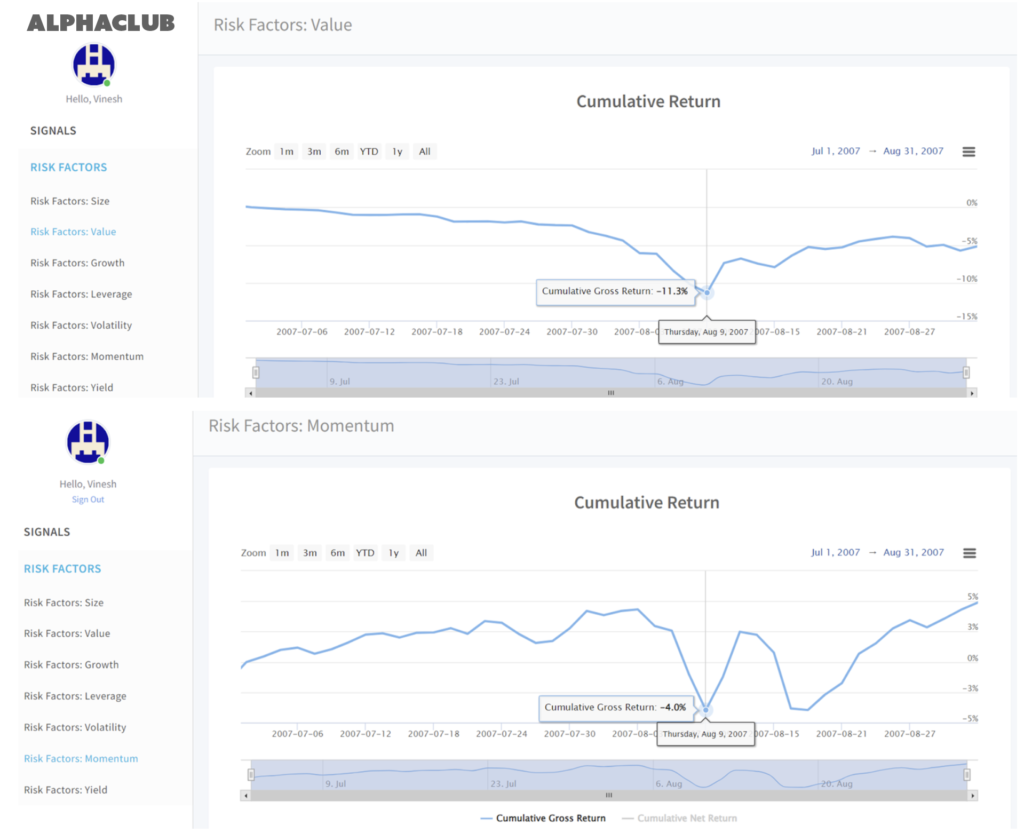

During the 2007 quant meltdown, for example, equity hedge funds running similar models all tried to unwind at once.

Losses cascaded, and the models were slow to recognize the new risk environment.

You see this dynamic in figure 2. The 2007 “Quant Quake” that blindsided the smartest factor models.

Both value and momentum funds took sudden, simultaneous losses.

Figure 2. “Quant Quake” in August 2007: Even the best factor models got blindsided. Both value and momentum strategies suffered sudden, sharp drawdowns. Source: ExtractAlpha.

Market psychology and sentiment are hard to quantify

Psychology and sentiment resist quantification. Algorithms process structured data.

But markets are driven by stories, emotions, and herd behavior as much as fundamentals.

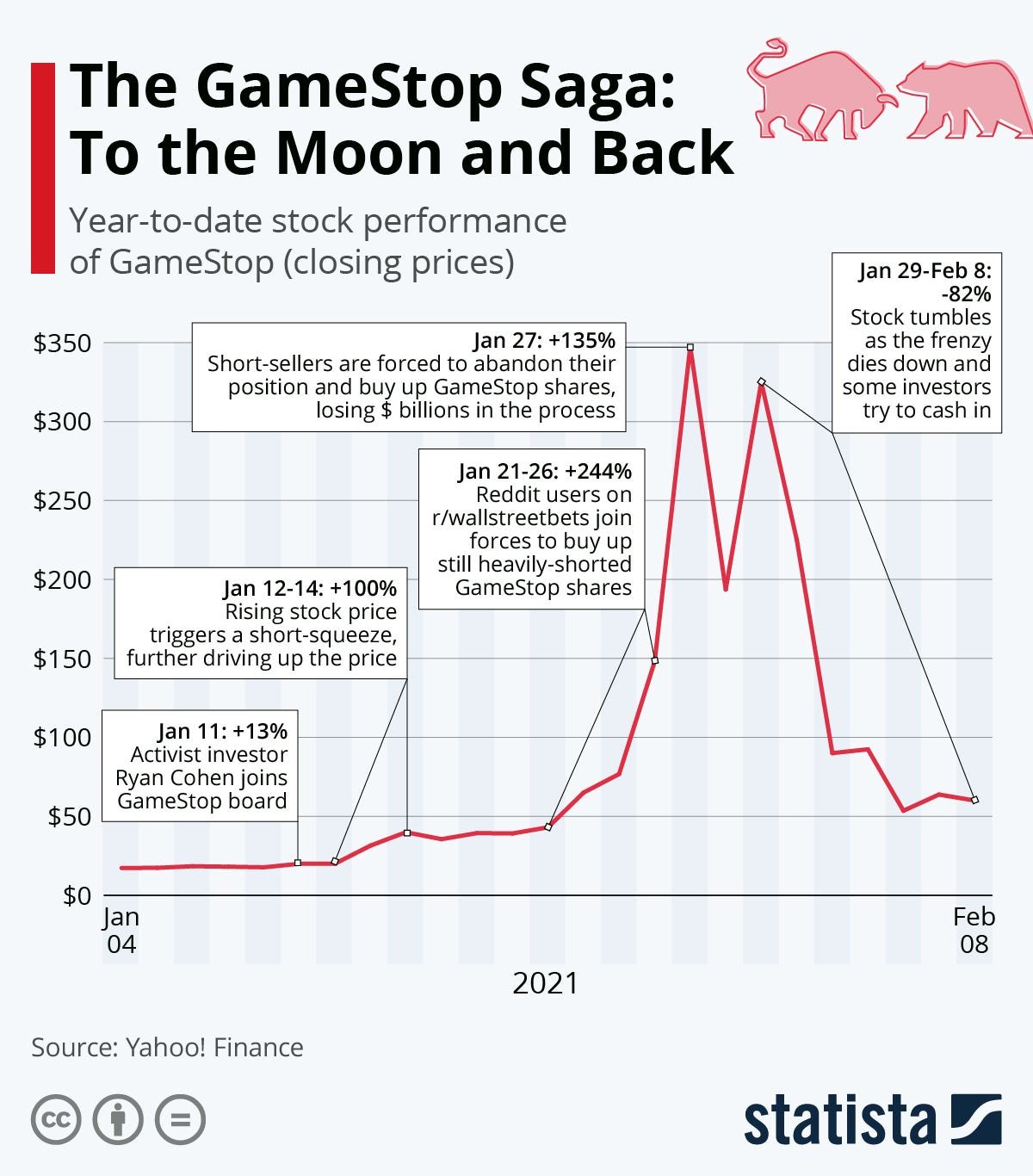

The rise of meme stocks in 2021, powered by social media rather than earnings, confused most models that relied on historical price or value signals.

GameStop’s moonshot in figure 3 was never in the model. Most quant funds missed the social story that powered the stock over 1,600% in weeks.

That’s a human phenomenon, not a spreadsheet pattern.

Figure 3. GameStop’s epic 2021 short squeeze: Retail traders fueled a parabolic rally that left most traditional models behind. The price soared over 1,600% in weeks, driven by collective action on social media. Source: Statista, based on Yahoo! Finance data.

Qualitative context is invisible to code

Context matters, but code doesn’t always catch it. Qualitative shifts are hard to program.

The human mind synthesizes these cues naturally. Models need explicit data and rules.

Algorithms are structured and consistent, but often slow to adapt to sudden change.

Human discretion can pause, question, or exit when things don’t add up. Models act as programmed.

For example, figure 4 shows years where the S&P 500 climbed even as technical momentum flashed repeated warnings.

Figure 4. This chart shows several years where the S&P 500 kept rising, even as momentum signaled repeated negative divergences. Source: seeitmarket.com.

The Human Advantage: What Data Can’t Capture

Intuitive Pattern Recognition

Experience builds a sense for patterns that doesn’t require perfect statistical proof.

Seasoned traders notice small shifts and subtle signals, even if the sample size is low or the data isn’t clear.

Experience builds a “mental database” of how markets behave under stress or euphoria.

You don’t need a 95% confidence interval to sense when something has changed.

Tacit Knowledge and Judgment

Experience builds judgment. Years of watching what works and what fails leaves a deep mark.

Humans know when to trust the model and when to override it. Recognizing when the data fits, and when it doesn’t, is a learned skill.

The best market calls come from pairing numbers with gut feel.

Figure 5. Correlations between equity market neutral hedge funds and the S&P 500. Discretionary and systematic funds show different correlation profiles over time. Source: Karl Rogers via LinkedIn.

Social and Narrative Context

Markets move on stories, not just earnings and rates. Social sentiment, collective psychology, and cultural moments often drive price action.

The meme stock rally in 2021 proved that a viral narrative can overpower any model.

Algorithms lag when the crowd creates new rules or when the market’s “story” changes overnight.

Flexibility and Creative Thinking

Humans adapt in real time. You can change your mind, pause, or even invent a new approach on the fly.

Models follow the code. People break the script, try something new, or react to the unknown with creative thinking.

Scenario planning and asking “what if?” is second nature for the best traders.

Leverage this analysis — and many others — through, Neural Trade, a unified engine built for financial data science and investment research.

Access 1000s of real-time data points, apply advanced AI methods, and uncover market structure with intelligent, pattern-aware tools.

Explore Neural Trade on Entreprenerdly:

Instinct in Action: Legendary Market Calls

Some of the most profitable trades in history started with a sense that something didn’t add up.

Paul Tudor Jones, Black Monday (1987)

Saw chart patterns and market euphoria mirroring that of 1929. Noticed portfolio insurance could trigger a selling spiral.

Shorted the market heavily. Crisis hit and his fund gained over 60%. Models amplified the crash.

Figure 6. 1987 Black Monday crash, where stocks lost nearly 25% in a single session. Source: Investopedia.com.

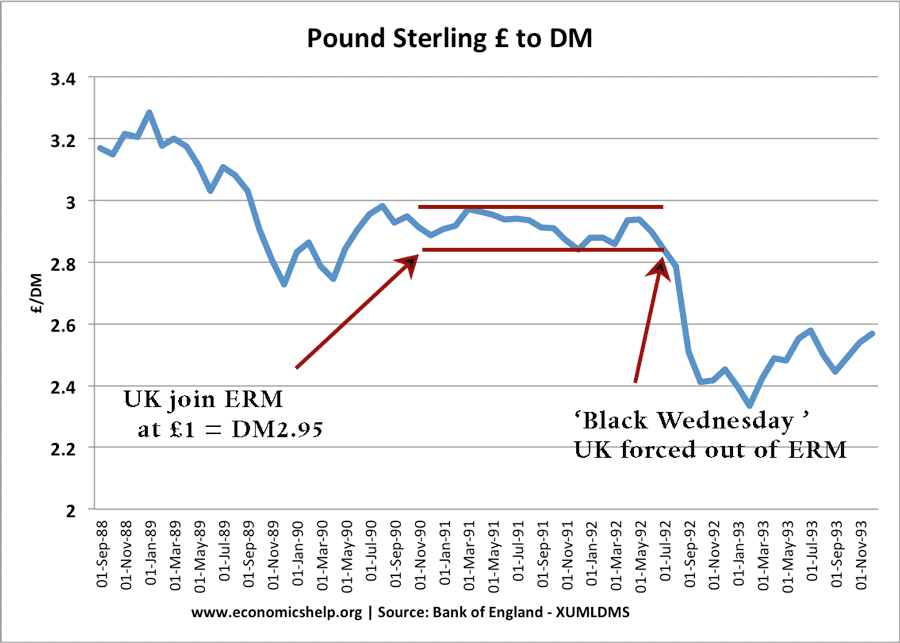

George Soros, Pound Sterling (1992)

Soros saw that Britain’s commitment to its currency peg was unsustainable.

Official models and policy statements said otherwise, but Soros noticed capital outflows and political reluctance to defend the pound at all costs.

Soros shorted sterling at scale. The Bank of England finally devalued. Soros made $1 billion in one night.

Figure 7. Pound sterling vs. Deutsche Mark, 1988–1993. The chart highlights the collapse of the pound on “Black Wednesday” as the UK exited the ERM, Source: Bank of England / economicshelp.org.

Michael Burry & John Paulson, Subprime Crisis (2007)

Burry pored over individual mortgage files, ignoring AAA ratings and the consensus that nationwide home price declines were impossible.

He saw declining lending standards and a feedback loop between housing prices and mortgage credit. Paulson reached a similar view.

They used credit default swaps to short subprime debt. Housing collapsed. Both made billions as consensus failed.

Figure 8 shows the build-up in subprime mortgage originations. Burry and Paulson looked past the consensus where models saw only growth.

Figure 8. Subprime mortgage originations exploded from 2003 to 2006, with securitized loans reaching record highs and accounting for nearly a quarter of all U.S. mortgages. Source: Inside Mortgage Finance.

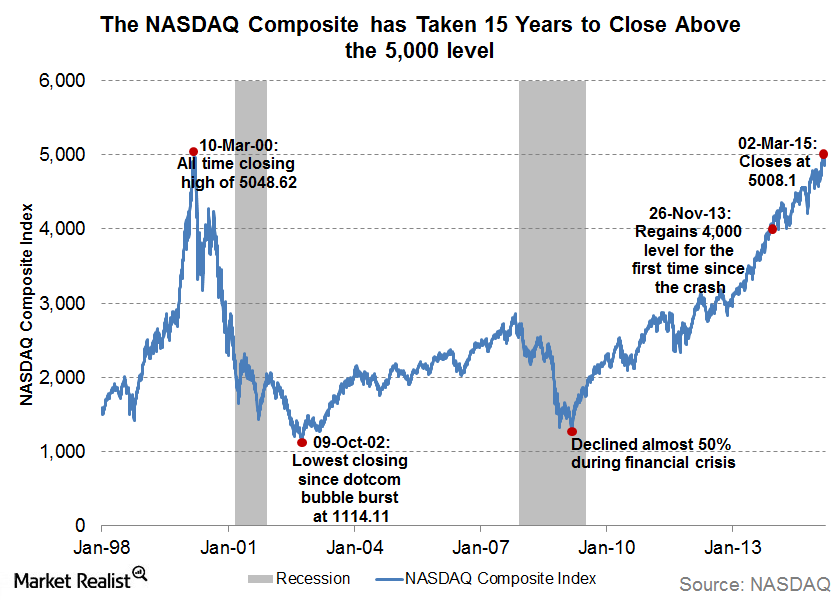

Stanley Druckenmiller, Dot-Com Bubble (1999)

Watched tech stocks soar with no earnings. His experience told him the story was running on hype

He scaled back his exposure, avoiding the crash that wiped out many peers. He acted because he sensed the narrative was unsustainable.

Figure 9. The NASDAQ Composite hit its dot-com bubble peak above 5,000 in March 2000, then collapsed and took 15 years to recover. Source: NASDAQ / Market Realist.

Meme Stock Mania (2021): Reddit vs. Wall Street

Traditional models shorted struggling retailers like GameStop. But retail traders, coordinated on social media, created a new feedback loop, pushing prices up.

Early adapters spotted the new narrative and rode the wave. Quant and value models lagged, caught by surprise.

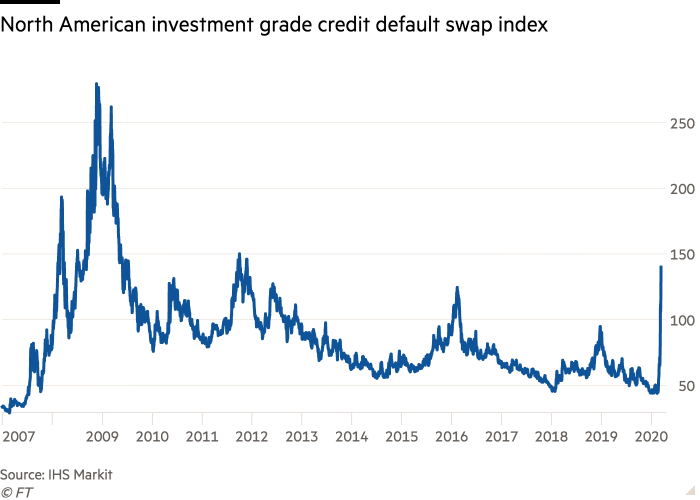

Bill Ackman, COVID Crash (2020)

Ackman grew alarmed by the global spread of the virus and slow government response, before most risk models adjusted.

He bought broad credit protection as insurance, warning publicly that “hell is coming”.

When panic hit markets, his hedge paid off. He turned $27 million into $2.6 billion. He then flipped and used his proceeds to buy into the rebound.

Figure 10. cost of credit default swaps on U.S. investment banks from 2007 to 2020. The spike in 2008 reflects market fears during the subprime crisis, while later surges highlight renewed stress, including during early 2020. Source: IHS Markit / Financial Times.

How to Know When to Trust Your Gut

Not every hunch is worth acting on. But experience teaches when a gut call adds value.

The best practitioners combine data with experience, but not all situations call for intuition. Here’s when it matters.

When the model lags a real-world shift

Quant systems excel in routine markets, but struggle when trends accelerate or reverse in new ways.

When price action disconnects from fundamentals on the upside or downside pay attention to what your instincts flag.

When narrative, not numbers, drives the market

Academic reviews show algorithms underperform when social sentiment or a new narrative takes over [Journal of Market Sentiment, 2024].

GameStop and Tesla in recent years both saw price moves that weren’t justified by old data or models.

If you sense the story is driving the trade, don’t ignore it, even if your model does.

When signals you trust start failing, or stop working

Regime changes happen on both sides, i.e. during melt-ups and meltdowns.

If a favorite strategy stops working, or if assets decouple from their usual correlations, that’s a sign the playbook is changing.

Research shows experienced traders outperform in these “regime shift” windows [Bloomberg Intelligence, 2024].

Experience compounds on both sides.

The more you’ve seen, e.g. rallies, busts, fads, and shifts, the sharper your sense for what’s “off”.

Models don’t know when something feels crowded, frothy, or ready for a turn.

That’s where instinct adds value, whether markets are falling apart or going parabolic.

When patterns emerge before they’re statistically significant.

You don’t need a hundred data points to sense when something new is underway.

Seasoned traders trust small-sample intuition, i.e. the ability to spot early signals before they show up in the backtest.

This matters as much when bubbles start forming as when markets crack.

Intuition Is Your Long-Run Edge

Experience compounds in the markets. Every cycle, bull or bear, teaches lessons that models can’t record.

The more you see, the sharper your sense for what matters.

Market intuition builds from seeing patterns repeat and knowing when this time really is different.

It’s the memory of past bubbles and crashes, but also the ability to spot early momentum or recognize when everyone else is late to the trade.

Wins and losses both count. You remember what worked, but you learn even more from what failed. Models don’t keep track of scars. Traders do.

Intuition synthesizes complexity. It lets you weigh qualitative data, rumors, and context that never show up in a spreadsheet.

The best practitioners are never rigid. They pair analysis with instinct, and they’re quick to act when the story changes.

In the long run, this edge adds up.

Data and algorithms set the baseline, but intuition is what keeps you in the game, cycle after cycle.

Final Thoughts

Developing market intuition allows you react faster, but more importantly to ask better questions when answers are uncertain.

As algorithms become more ubiquitous, the rare skill may be the ability to blend human nuance with machine efficiency.

Thank you for taking the time to read.

Newsletter