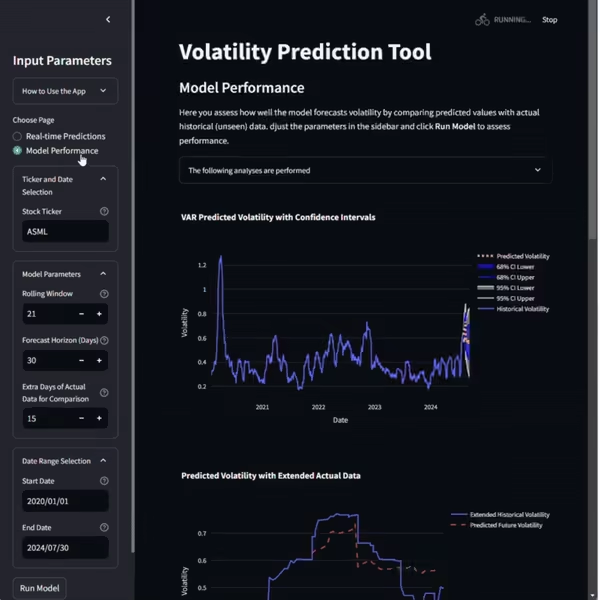

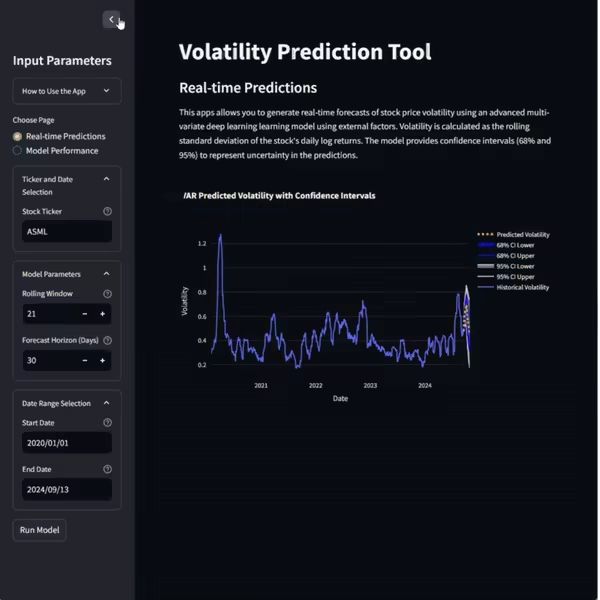

Performance Tracking and Error Evaluation

Beyond forecasts, the tool includes performance evaluation analyses to compare predictions against actual market data. Key metrics like RMSE and R² offer clear insights into model accuracy, while residual analysis helps identify and correct forecast errors for better future predictions.