Experience the Future of Intelligent Investing Today

Back To Top

Experience the Future of Intelligent Investing Today

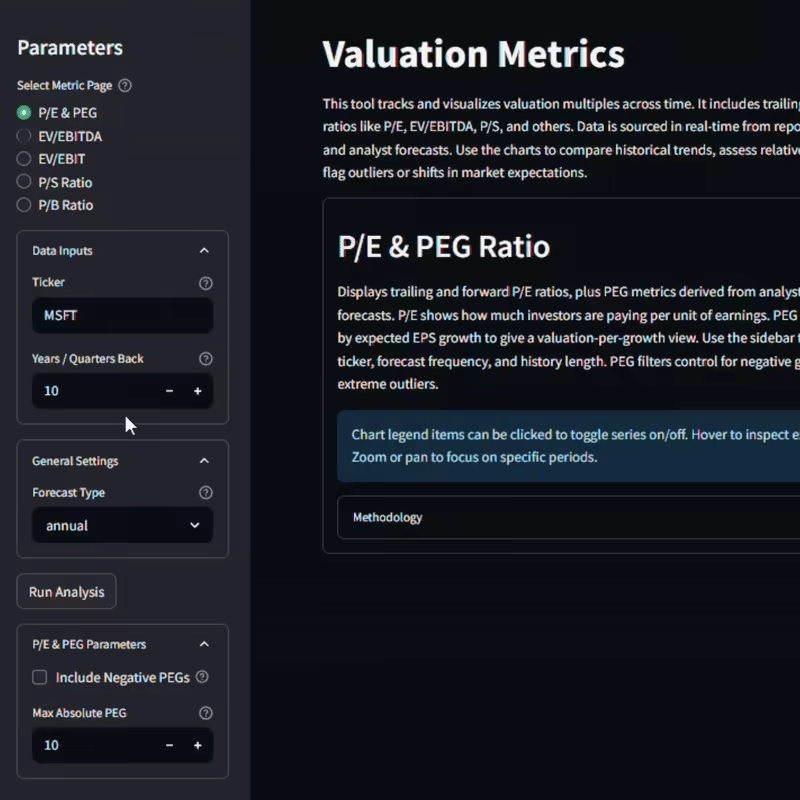

Valuation Coverage: P/E, PEG, EV/EBITDA, EV/EBIT, P/S, and P/B ratios

Forward Forecast Integration: Analyst estimates with low, average, and high scenarios

Growth-Adjusted Metrics: PEG ratios with customizable filters for extreme values

Capital Structure Neutral: EV-based ratios capture true enterprise-level valuation

Interpretation Engine: Automated narrative explains what each chart implies

Interactive Charts: Zoom, hover, and toggle time series for clarity

Daily Price Overlay: Compare valuation ratios against actual market action

Flexible Granularity: Choose annual or quarterly data for better alignment

$8/month

Free