News Hurts Your Returns. It’s Biased, Sensational, and a Losing Game. Here’s Why You’ll Invest Better.

Most stock market news does not inform. It distracts, misleads, and amplifies anxiety.

Investors doomscroll through conflicting headlines, stress over breaking alerts, and fear missing out on the next big move.

But frequent news readers underperform. Barber and Odean (2007) found that trading on news costs individual investors over 6% a year.

What is worst is that nearly every major broadcaster, left or right, frames market events to fit a political or commercial agenda.

The same jobs report sparks hope at The Washington Post, worry at The Wall Street Journal, and cautious neutrality at The New York Times.

The narrative depends on who’s selling it. And they make sure the evidence they bring fits that narrative.

Stick to the facts. Ignore the noise. Form your own view.

Figure 1. Three major newspapers, one jobs report with three narratives. The Washington Post calls it “hope,” The Wall Street Journal fuels “worry,” and The New York Times strikes a cautious middle ground. Source: The Atlantic

Why Financial News Exists. It’s Not for Your Benefit

Financial news outlets do not exist to help you invest better. Their business depends on attention, clicks, and ad revenue. Not on your results.

Headlines are engineered to spark fear, greed, and outrage. Shifts in tone turn ordinary events into breaking news.

Every market dip becomes a crisis. Every rally gets framed as the next bubble. Sensationalism keeps you coming back.

Recent headlines say it all:

- “Stocks Crash as Recession Fears Mount”

- “Markets Soar on Surprise Jobs Report”

- “Is the Bull Run Over? Experts Weigh In”

The stories rarely match the reality.

News sells. That’s the real agenda. Most stories make you anxious, not informed.

Bias is not an accident. It’s the model.

CNBC and Bloomberg can frame the same event as a disaster or an opportunity, depending on what drives engagement.

Fox Business spins optimism from volatility; CNN sells caution as crisis.

If you trade based on the opinions of these reporters and so called experts, you are probably losing money.

Consider the following chart: If you tracked the DAX only on days it made the news, you’d see a 50% loss since 2017.

The real index rose nearly 75%. Headline-driven coverage distorts the long-term reality.

Figure 2. If you tracked the DAX only on days it made the news, you’d see a 50% loss since 2017. The actual index rose nearly 75%. Headline-driven reporting distorts the true, long-term picture. Source: Ciccone & Rusche, VoxEU/CEPR.

How Biased News Manipulates Investor Behavior

Agenda-driven news distort the facts, but also warps how you think. Recency bias keeps you glued to the latest headlines.

Confirmation bias tricks you into seeking stories that match your fears or hopes.

Behavioral finance research, from Kahneman to Barberis, proves these instincts drive bad decisions.

You see it every day. A friend panic-sold after a dramatic headline on a trade war, only to watch markets rebound the next week.

I’ve chased “breaking news” tips, convinced I was one step ahead. Every time, my results suffered.

The problem isn’t just the news. It’s how news amplifies our worst instincts.

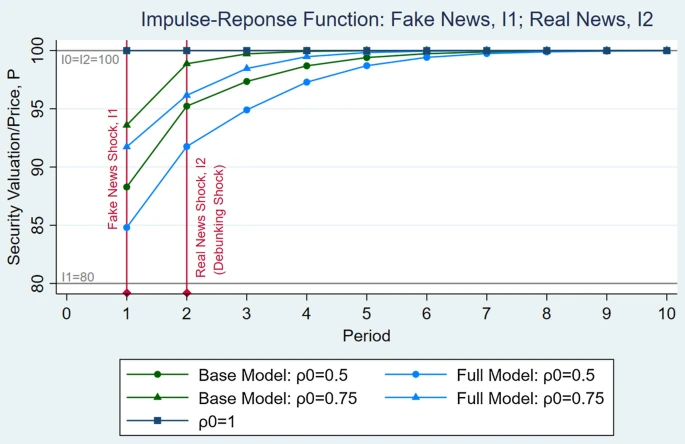

Figure 3 shows what happens when fake news hits the market. Prices drop sharply. Even after the truth comes out, the recovery is slow.

Figure 2. How Fake News Distorts Prices And Why the Truth Takes Time to Sink In: A fake news shock drives prices down sharply. Even after the truth comes out (debunking shock), prices recover only gradually. Source: Fong (2021).

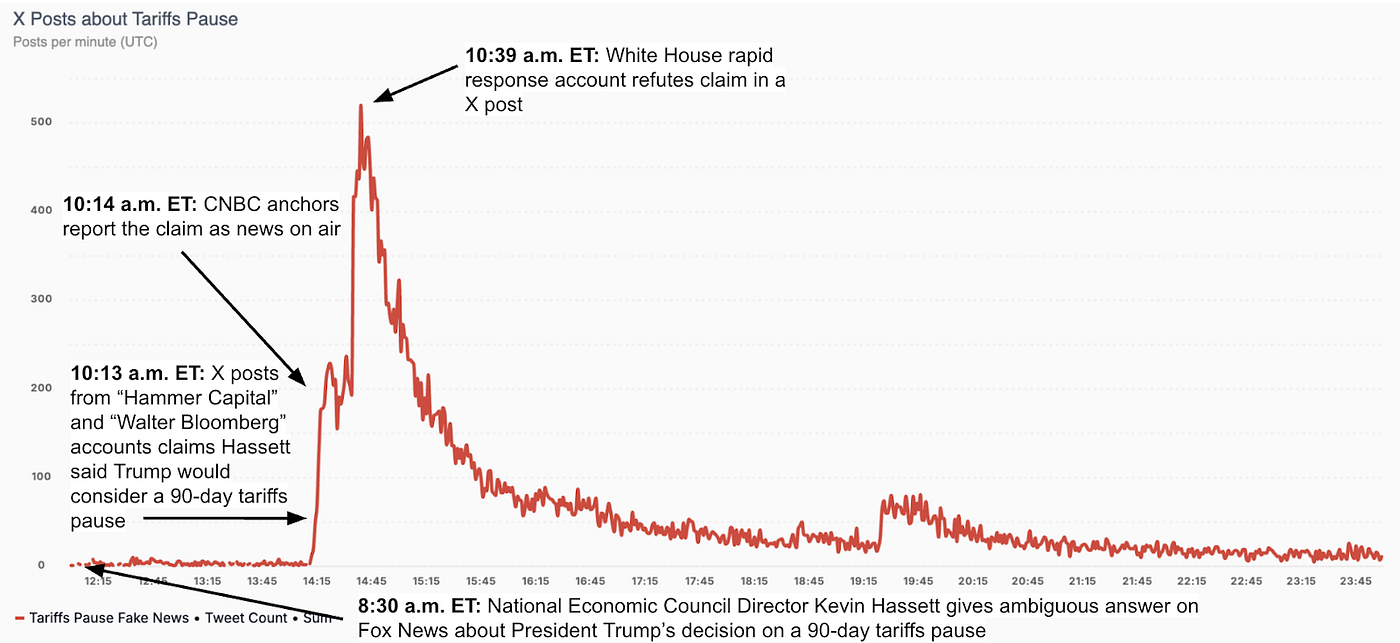

Figure 3 further drives the point home. A false “tariffs pause” headline exploded across social media and live TV.

Within 30 minutes, it moved the entire market, then reversed just as quickly once debunked. One rumor, 5,100 posts, millions in volatility.

Figure 3. A false claim about a “90-day tariffs pause” exploded across social media and live new and sparked 5,100 posts and a sharp market reaction before the White House denied it, all in under 30 minutes. Source: PeakMetrics.

The Data: Does Headline-Chasing Work?

Every time you react to a headline, someone else cashes in. Study after study shows: news-driven traders lose out. Buy-and-hold investors win.

Academic research confirms it. Investors who trade on news underperform by over 6% a year.

Mark Hulbert tracked thousands of newsletters and found the same: headline-chasing strategies lagged simple, passive portfolios.

Warren Buffett says it best:

The more you react, the more you pay.

If you won’t buy and hold, at least dig deep and form your own view.

Watch how every broadcaster pushes an agenda, inviting “experts” to reinforce their chosen narrative.

Can You Really Ignore the News? (And How To Start)

Set filter rules: ignore any story that doesn’t affect your investment thesis or the long-term fundamentals.

Build your own thesis for every stock you own. Write down why you bought it, what would change your mind, and what data actually matters.

Review headlines only with those points in mind.

Try this: for one week, track headlines from both left- and right-leaning outlets.

Compare their narratives and then compare both to the actual price moves. You’ll see how little news noise matches market reality.

Do your own due diligence. Read 10-Qs and 10-Ks. Ignore headlines that shout “crash,” “plunge,” or “surge.”

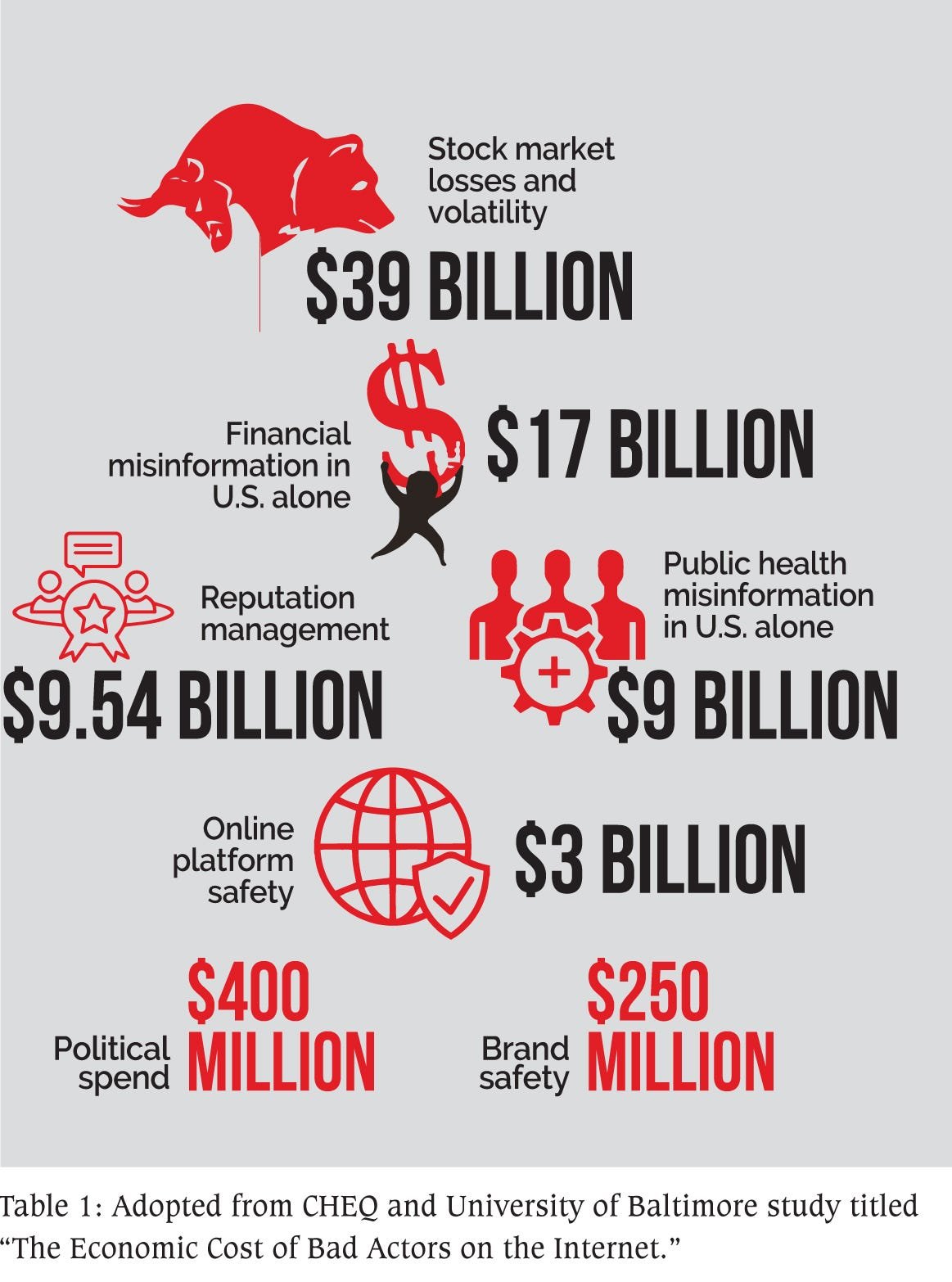

Remember, misinformation isn’t just annoying. It’s a multibillion-dollar drag on markets. See image below to understand the scale.

Figure 3. Misinformation is a multibillion-dollar risk. Fake news costs the U.S. stock market $39 billion in losses and volatility every year. Source: CHEQ & University of Baltimore study via IBT

Final Thoughts

Most investors waste hours chasing stories they can’t control.

You get ahead by tuning it out and letting your results speak for themselves.

Thank you for taking the time to read.

Newsletter