Experience the Future of Intelligent Investing Today

Back To Top

Experience the Future of Intelligent Investing Today

Renaissance Technologies, the quant investing giant, adjusted its $67.6 billion portfolio in Q4 2024 with a clear strategy shift.

The firm increased stakes in AI and fintech while cutting exposure to big tech to respond to shifting market dynamics.

Palantir’s growing government contracts signaled sustained revenue potential, while Robinhood’s surge in retail trading activity presented a short-term liquidity play.

Meanwhile, Microsoft’s slowing Azure growth and Novo Nordisk’s regulatory risks justified a reduction in exposure to mitigate downside risk.

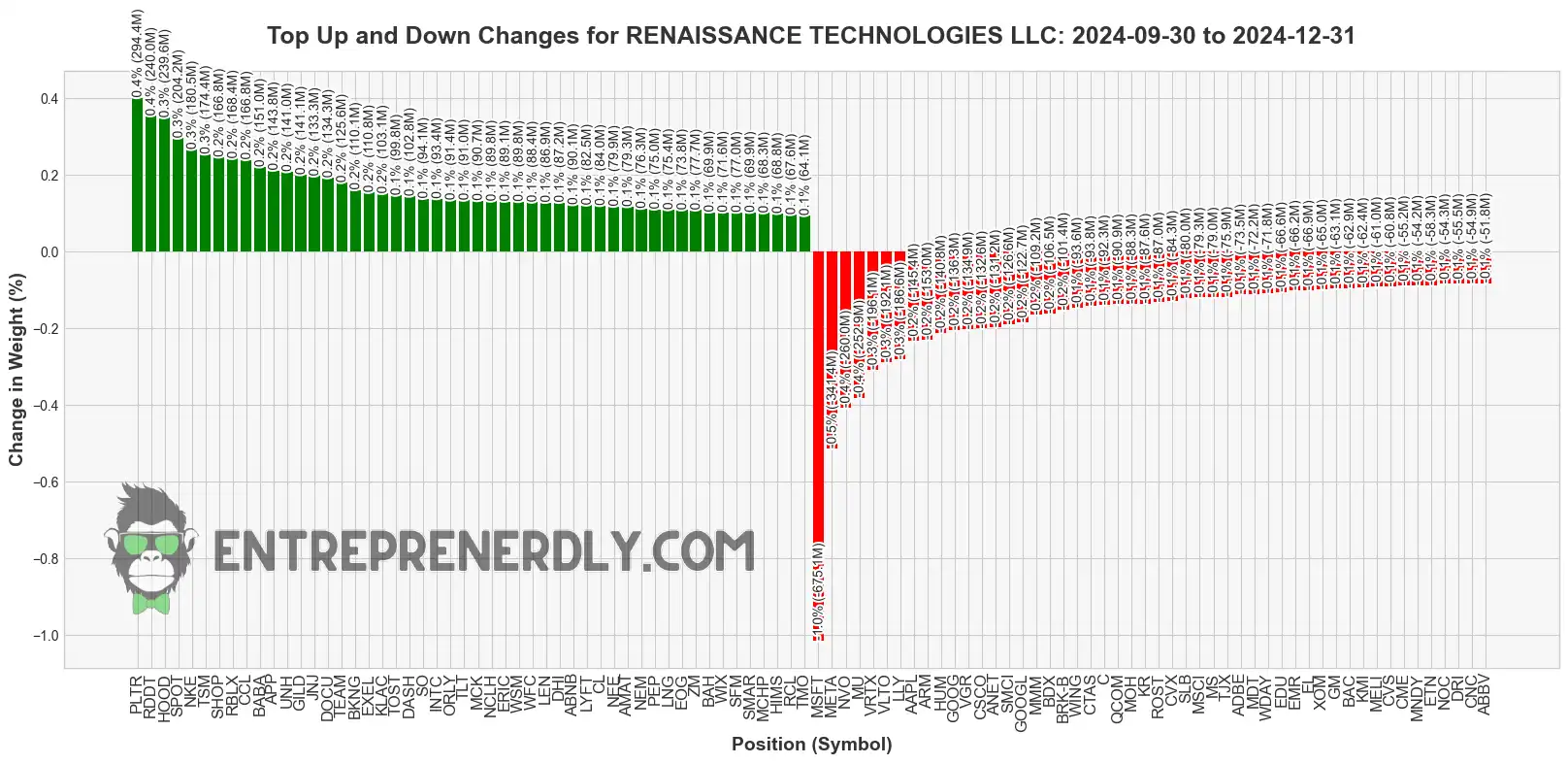

Figure 1: Top Position Changes (From September 30, 2024, to December 31, 2024) - The biggest increases and decreases in RENTEC's portfolio over the last quarter.

Renaissance boosted its stake in Palantir by 0.4% ($294.4M), betting on its $823M AI contract with the Defense Department.

Alternative data showed a 94% year-over-year surge in government agency logins, reinforcing the investment case.

Reinforcement learning models prioritized Palantir’s 63% gross margin over its high valuation (P/S 22.4x), which signaled confidence in sustained growth (Morgan Stanley)

A 0.3% ($239.6M) increase in Robinhood reflected Renaissance’s strategy to capitalize on a 182% quarter-over-quarter spike in retail options trading.

Liquidity arbitrage models detected a 2.3x bid-ask spread compression during crypto rallies, making Robinhood a tactical play.

However, with a 23.1% short interest, the position remained capped at 0.7% of the portfolio to manage downside risk Institutionalinvestor.com.

Renaissance added 0.3% ($174.4M) to its Taiwan Semiconductor position, aligning with a bullish stance on AI chip infrastructure.

Supply chain data showed a 34% year-over-year rise in extreme ultraviolet (EUV) lithography orders, a key technology for next-gen chip production.

Geopolitical risk models weighted TSM 2.1x higher than U.S. semiconductor peers after U.S. export controls were eased in October 2024.

Renaissance trimmed its Microsoft stake by 1.0% ($675.1M) driven by a factor rotation strategy. Azure’s revenue growth slowed to 19% year-over-year from 27% in the prior quarter.

Graph neural networks flagged a 73% overlap in institutional ownership, raising crowding risk. Liquidity concerns justified the reallocation, shifting capital into higher Sharpe ratio plays like Palantir (Sharpe 1.4 vs. Microsoft 0.9) (Institutionalinvestor.com, man.com).

A 0.4% ($260M) reduction in Novo Nordisk reflected regulatory and supply chain concerns.

The FDA issued a warning in November 2024 on off-label GLP-1 drug use, creating headwinds for sales.

Satellite data showed a 22-day production backlog at Danish facilities for Wegovy, raising supply chain stability concerns (Rentec).

Renaissance cut its Micron allocation by 0.4% ($252.9M) due to deteriorating memory market conditions.

DRAM spot prices dropped 14% quarter-over-quarter, triggering a model-driven liquidation threshold.

Cross-asset signals reinforced the move, as Bitcoin mining chip orders fell 39%, weakening demand for high-performance memory modules (Institutionalinvestor.com).

Use Entreprenerdly’s Institutional Portfolio Allocation Activity to stay up to date with the latest Institutional Portfolio Movements.

Newsletter