Expected Stock Price Movement with Python

Figure 1. Projected Stock Price Movement for ASML.AS over a 20-Day Horizon: Visualizing the Impact of Different Volatility Multipliers on Expected Price Ranges.

Few concepts are as captivating as predicting stock price movements. Every trader, investor, and analyst has, at one point or another, attempted to forecast where the price of a particular stock might head. While there are myriad methods and strategies employed in this quest, one underlying principle often stands out: the role of volatility.

Volatility, in the simplest terms, is a measure of the dispersion of returns for a given stock or market index. It provides a glimpse into the degree of variation one might expect over time. The greater the volatility, the wider the range in which the stock price might fluctuate. Mathematically, volatility (σ) can be represented as the standard deviation of daily returns.

Equation. 1: Formula representing the historical volatility of stock returns, where σ is the standard deviation (volatility) and ri denotes individual stock returns over a time period N.

- σ is the standard deviation (volatility).

- N is the number of observations.

- ri is the return at the ith observation.

- rˉ is the average return over the period.

Intuitively, this formula showcases how we quantify the degree to which a stock’s price can swing. A stock with higher volatility might see rapid and sizable price changes, signaling risk, but also potential opportunity for profit. Conversely, a stock with low volatility might exhibit more stable, less dramatic price changes, implying a more predictable, albeit potentially less lucrative, trajectory.

In this article, we’ll leverage the power of Python to visualize expected stock price movements based on varying levels of volatility. Using volatility multipliers, we will amplify or dampen our predictions, allowing for a spectrum of potential outcomes. Whether you’re a seasoned trader or a finance enthusiast, understanding and visualizing these predictions can provide a unique lens through which to view the dynamic world of stock trading.

1. Understanding the Volatility Cone

With the increased importance of volatility in the modern stock market, visualizing expected stock price movement using volatility cones provides a more tangible grasp. The cone, defined by upper and lower bounds, illustrates potential stock trajectories based on historical volatility.

Why the Cone?

- The cone of volatility is a visual tool that helps traders understand the range in which a stock price might move in the future based on its past volatility.

- It narrows down the infinite possibilities of future stock movements into a probable range.

- The cone’s width at any given future point represents the uncertainty or risk associated with the stock.

Calculating Daily Returns:

stock_data['Returns'] = stock_data['Close'].pct_change()

This simple formula calculates the percentage change in the closing price from the previous day, giving the daily returns.

How the Cone is Constructed:

- Historical Volatility: By using the standard deviation of daily returns, we get a measure of the stock’s historical volatility.

- Expected Price Movement: This is calculated by multiplying the current stock price with the historical volatility and a factor that considers the time horizon and the standard deviation multiplier.

- Upper and Lower Bounds: These are then derived by adding and subtracting the expected price movement from the current price.

2 Diverging Methods of Calculating Volatility

Volatility, as an indispensable measure of stock price fluctuations, can be calculated in various ways, each offering a unique perspective and relevance based on the use-case:

Historical Volatility

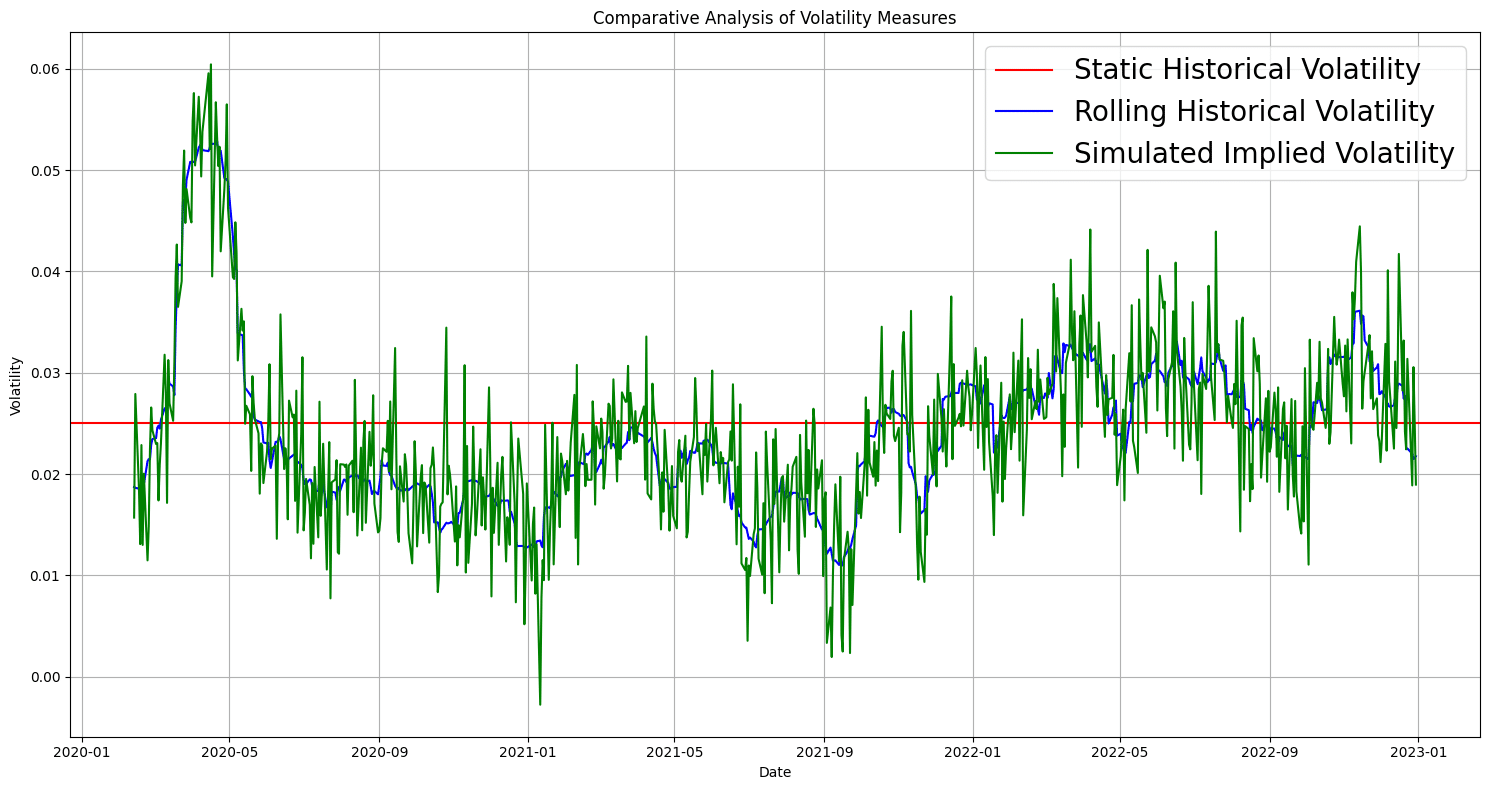

- Static Historical Volatility: This method calculates the standard deviation of daily returns over a fixed period, like 30, 60, or 180 days, without any shift in the time window. While it offers a snapshot of past volatility, it might not be responsive enough to capture recent market dynamics.

volatility_static = stock_data['Returns'].std()

Rolling Historical Volatility: Instead of sticking to a fixed time frame, the rolling method calculates volatility over a defined window that moves day by day. This approach provides a dynamic measure of volatility, capturing more recent market behavior and trends.

volatility_rolling = stock_data['Returns'].rolling(window=30).std()

Implied Volatility

Implied Volatility is not directly based on past stock price movements. Instead, it’s derived from the market price of an option and reflects the market’s expectation of how volatile the stock will be in the future. It’s a crucial metric for options traders and is often used in models like Black-Scholes for option pricing. A higher IV suggests that the market expects the stock to make substantial moves, while a low IV indicates expectations of lesser price movements.

If you’re utilizing Python, tools like the mibian library can be used to calculate implied volatility. For instance:

import mibian

c = mibian.BS([Current stock price, Strike price, Interest rate, Days to expiration], callPrice=Call option price)

implied_volatility = c.impliedVolatility

Note: Implied volatility calculation requires several inputs, including current stock price, strike price, interest rate, days to expiration, and either the current call or put option price. Also, the real-world calculation of IV can be more complex due to other market factors and variations in option pricing models.

Figure 2. Comparative Analysis of Volatility Measures: A visualization of Static Historical Volatility, Rolling Historical Volatility, and Simulated Implied Volatility over time.

In the ever-evolving realm of stock trading, being able to leverage the power of data and statistics offers a significant advantage. Whether it’s forecasting future prices, analyzing market trends, or simply gauging the volatility of a particular stock, data-driven insights have transformed the way traders approach the stock market. Enter the Z-Score, a statistical measure that can provide traders with invaluable insights into the relative strength and positioning of a stock.

Imagine being able to identify when a stock might be overbought or oversold simply by looking at its past prices and volatility. This is precisely what the Z-Score can offer, and in this article, we’re going to deep dive into how Python — a powerhouse in data analysis — can be harnessed to calculate and interpret Z-Scores for stock trading.

3. Using Volatility for Price Projections

Volatility offers a mathematical foundation to gauge potential future stock price movements. By considering volatility multipliers and different methods of calculating volatility, one can generate a spectrum of price projections. These projections are not predictions set in stone but rather, probabilistic estimations of where a stock might venture.

Importance of Volatility Multipliers

Multipliers are used to stretch or squeeze the cone of volatility, effectively illustrating optimistic, neutral, and pessimistic scenarios. For instance:

- A 1x multiplier might represent the “most likely” scenario.

- A 2x multiplier could depict an extreme case, considering increased market unpredictability.

- Using multipliers less than 1 might provide conservative estimates, beneficial for risk-averse investors.

Price Projection Formula

When we think about price projections using volatility, we inherently contemplate the potential range within which a stock might move, both upwards and downwards. This range is determined by considering the current price, volatility, and a specific multiplier. The multiplier magnifies the effect of volatility to create a spectrum of potential outcomes.

The formula for these projections, considering the potential for both upward and downward movements, can be expressed as:

Equation. 2: Formula representing the historical volatility of stock returns, where σ is the standard deviation (volatility) and ri denotes individual stock returns over a time period N.

Where:

- Current Price: The latest available stock price.

- Volatility: The chosen measure of volatility (historical, rolling, or implied).

- Multiplier: A factor to adjust the magnitude of volatility’s effect.

Let’s break this down:

- The multiplication of volatility and the multiplier determines the percentage by which we expect the stock price to change.

- For the upper bound, we consider the possibility of the stock price increasing. We thus add the product of volatility and the multiplier to 1 and then multiply by the current price.

- For the lower bound, we entertain the potential for the stock price to decrease. Here, we subtract the product of volatility and the multiplier from 1 before multiplying by the current price.

This formula’s beauty lies in its simplicity, offering a range-based outlook while being rooted in the mathematical characterization of volatility. By adjusting the multiplier, one can effectively gauge optimistic, neutral, and pessimistic scenarios.

4. Python Implementation

In this section, we’ll discuss the Python code that was used to generate the cone of volatility. This code uses historical stock price data to calculate and visualize potential price trajectories based on past volatility.

Setting Up the Python Environment

Before executing the script, it’s crucial to have the right Python environment set up:

- Installing Necessary Libraries: You’ll need to ensure that the required libraries, including

numpy,pandas,yfinance,matplotlib, andscipy, are installed. This can be done using pip:

pip install numpy pandas yfinance matplotlib scipy

Fetching Data and Preliminary Analysis

The code employs yfinance to download historical stock data:

- Installing

yf.download(), the code fetches the historical stock data for the given ticker over the specified date range. - The daily returns, which are the percentage changes in the closing prices, are computed using the

pct_change()function on the ‘Close’ column.

Calculating and Plotting the Cone of Volatility

Here’s a step-by-step breakdown:

1. Initialization: Multipliers for standard deviation are defined. These will be used to determine the width of the cone of volatility.

2. Looping Through Multipliers:

- For each multiplier, the cone of volatility is calculated and plotted.

- A date range for the future time horizon is defined.

3. Rolling Window Volatility:

- The volatility is calculated using a rolling window approach of the last 30 days. This rolling window shifts forward one day at a time, ensuring only a fixed, recent interval is used for calculations.

- Expected price movement is determined using the formula incorporating volatility, standard deviation multiplier, and time horizon.

- The cone’s bounds are calculated for both upper and lower limits.

4. Expanding Window Volatility:

- Volatility is determined using all available data up to the current day, expanded one day at a time.

- Similarly, the price movement and the cone’s bounds are calculated.

5. Vizualization:

- The past 30 days of stock prices are plotted alongside the expected price cones using

matplotlib. - Price labels are added every 5 days to give clearer insights into the expected price range.

- Each plot is customized with labels, grid lines, and titles to make the visual representation more informative.

Putting it all together:

Newsletter