Berkshire's Latest Moves: More Apple, More AXP, Trims Coca-Cola and Nu Bank, and a $325B Cash Stack

Warren Buffett just shook up Berkshire Hathaway’s $267.2 billion portfolio, and the latest moves reveal a clear strategy: more cash, fewer banks, and a surprising bet on fast food.

With Apple still dominating (28.1% of the portfolio) and a massive $325.2 billion cash reserve, Berkshire is positioning itself for big opportunities.

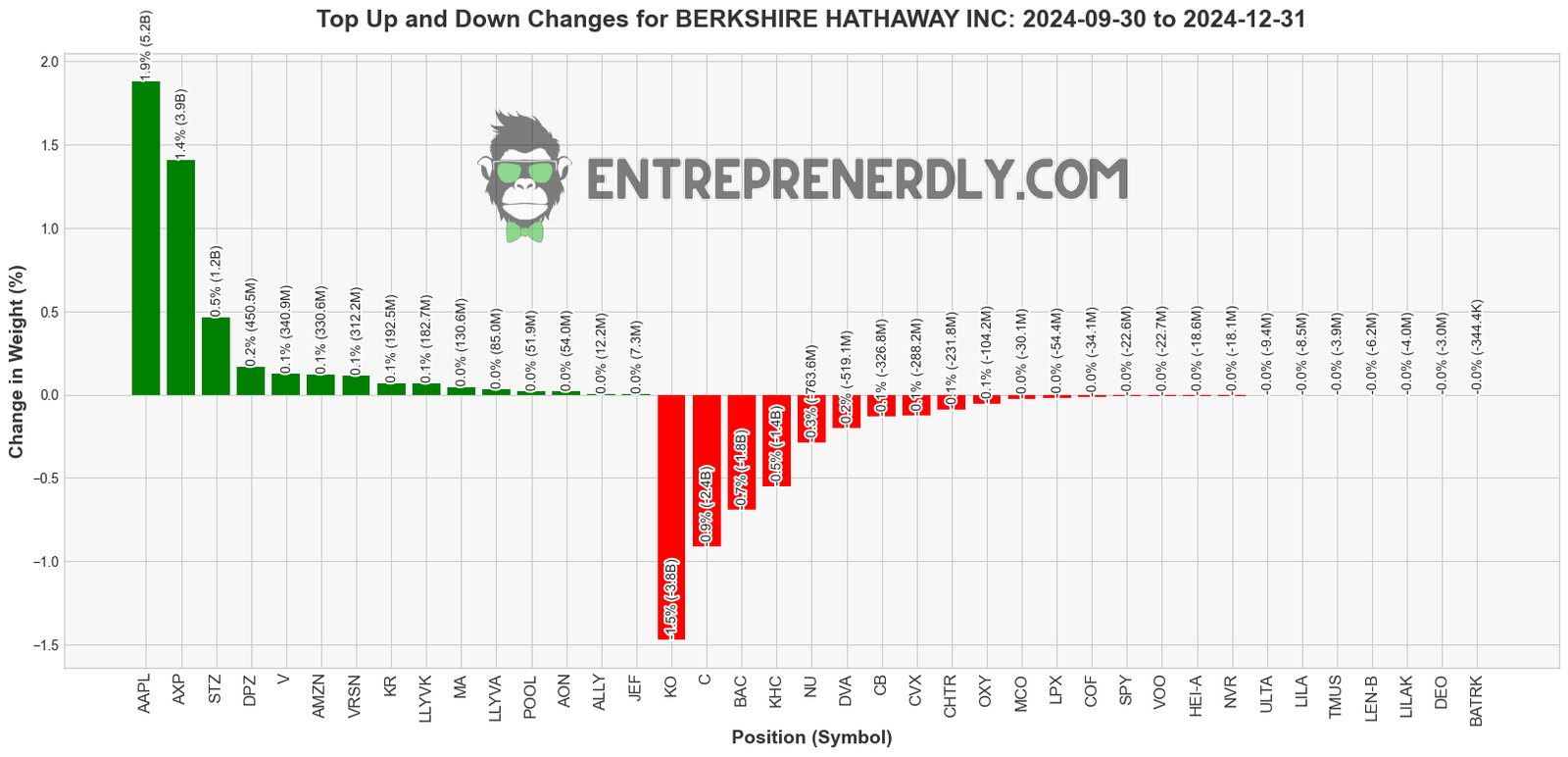

Figure 1: Top Position Changes (From September 30, 2024, to December 31, 2024) - The biggest increases and decreases in Berkshire Hathaway's portfolio over the last quarter.

Buffett’s Biggest Moves in Q4 2024

The Apple Rollercoaster: +1.9% ($5.2B)

Berkshire slashed its Apple stake by 66% since early 2024 but added back $5.2 billion in Q4. Why? Likely because Apple dipped below $175/share, and Buffett saw an opportunity.

Apple’s services revenue is up 19% year-over-year, and with 2.2 billion active devices, the long-term story still holds (Yahoo Finance, brk-b.com).

More American Express, Less Bank of America

Berkshire added $3.9 billion to its American Express (AXP) position, betting on its closed-loop network.

The Credit Card Competition Act could weaken Visa and Mastercard, leaving AXP in a prime spot to gain market share.

Meanwhile, Buffett trimmed Bank of America (BAC) by $1.8 billion, likely to avoid regulatory scrutiny as his stake neared 10% (moomoo.com).

A Surprising Bet on Domino’s Pizza: +0.2% ($450M)

Berkshire added a small but notable $450 million stake in Domino’s Pizza (DPZ).

With 45% of its orders placed digitally and store-level EBITDA margins hitting 29.4%, DPZ is an inflation-resistant cash machine.

Buffett seems to be favoring consumer discretionary plays over traditional energy and banking bets.

Selling Off Coca-Cola for the First Time in Decades: -1.5% (-$3.8B)

Buffett took some profits on Coca-Cola (KO), selling $3.8 billion worth of shares.

With KO trading at a forward P/E of 26x — well above its 10-year average — this move aligns with Berkshire’s valuation discipline.

The stock still makes up nearly 10% of the portfolio, but this marks a rare cut to one of Buffett’s longest-held positions (kiplinger.com).

Exiting NU Holdings: Less Emerging Market Risk? -0.3% (-$764M)

Despite NU’s rapid 45% YoY customer growth, Buffett slashed his stake by $764 million.

Why? The Brazilian real dropped 18% against the U.S. dollar in 2024, and lower interest rates are squeezing returns.

Buffett isn’t known for taking emerging market risks, and this move proves it (gurufocus.com).

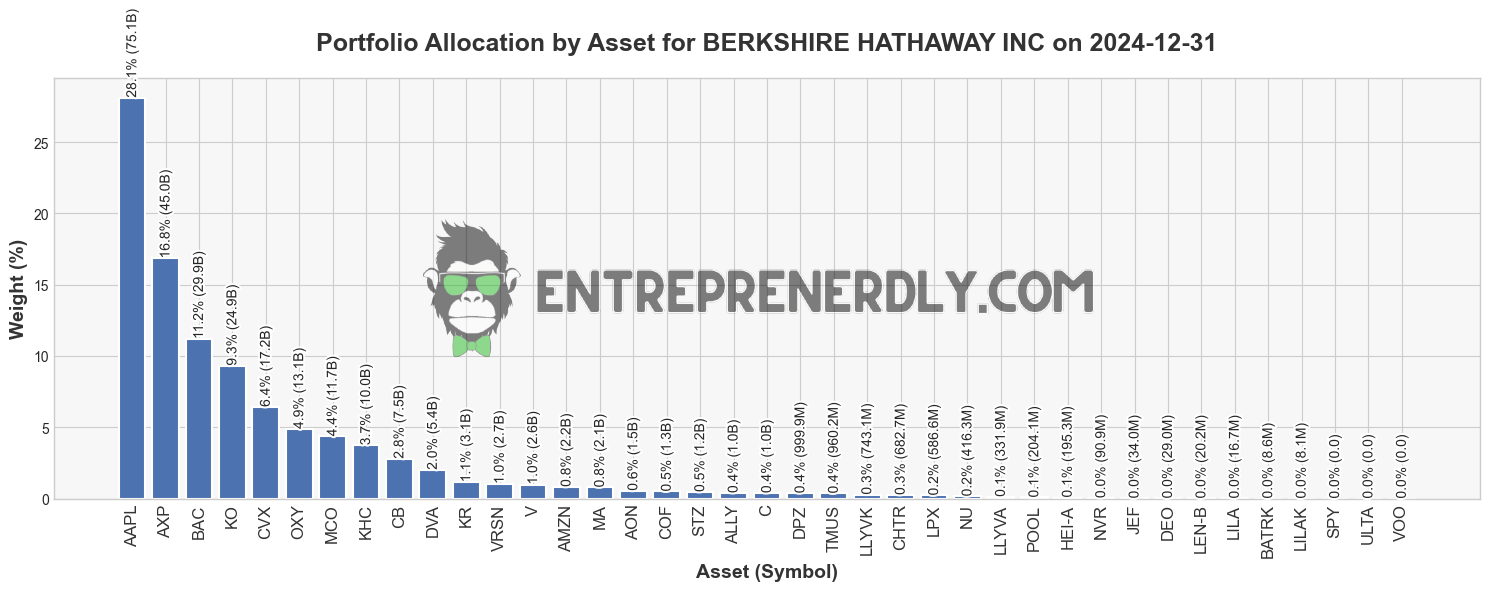

Latest Portfolio Asset Allocation

Figure 2: Portfolio Allocation by Asset (As of December 31, 2024) - A breakdown of Berkshire Hathaway's holdings by asset.

Berkshire’s portfolio as of December 31, 2024, is dominated by a few key assets:

- Apple (AAPL): 28.1% ($75.1B)

- American Express (AXP): 16.8% ($45.0B)

- Bank of America (BAC): 11.2% ($29.9B)

- Coca-Cola (KO): 9.3% ($24.9B)

- Chevron (CVX): 6.4% ($17.2B)

- Occidental Petroleum (OXY): 4.9% ($13.1B)

- Moody’s (MCO): 4.4% ($11.7B)

- Kraft Heinz (KHC): 3.7% ($10.0B)

- Chubb (CB): 2.8% ($7.5B)

- DaVita (DVA): 2.0% ($5.4B)

- Other holdings make up the remaining 10.4% of the portfolio.

Berkshire’s top five holdings still account for nearly 75% of its total portfolio value.

This reflects Buffett’s preference for concentrated bets in companies with strong competitive advantages.

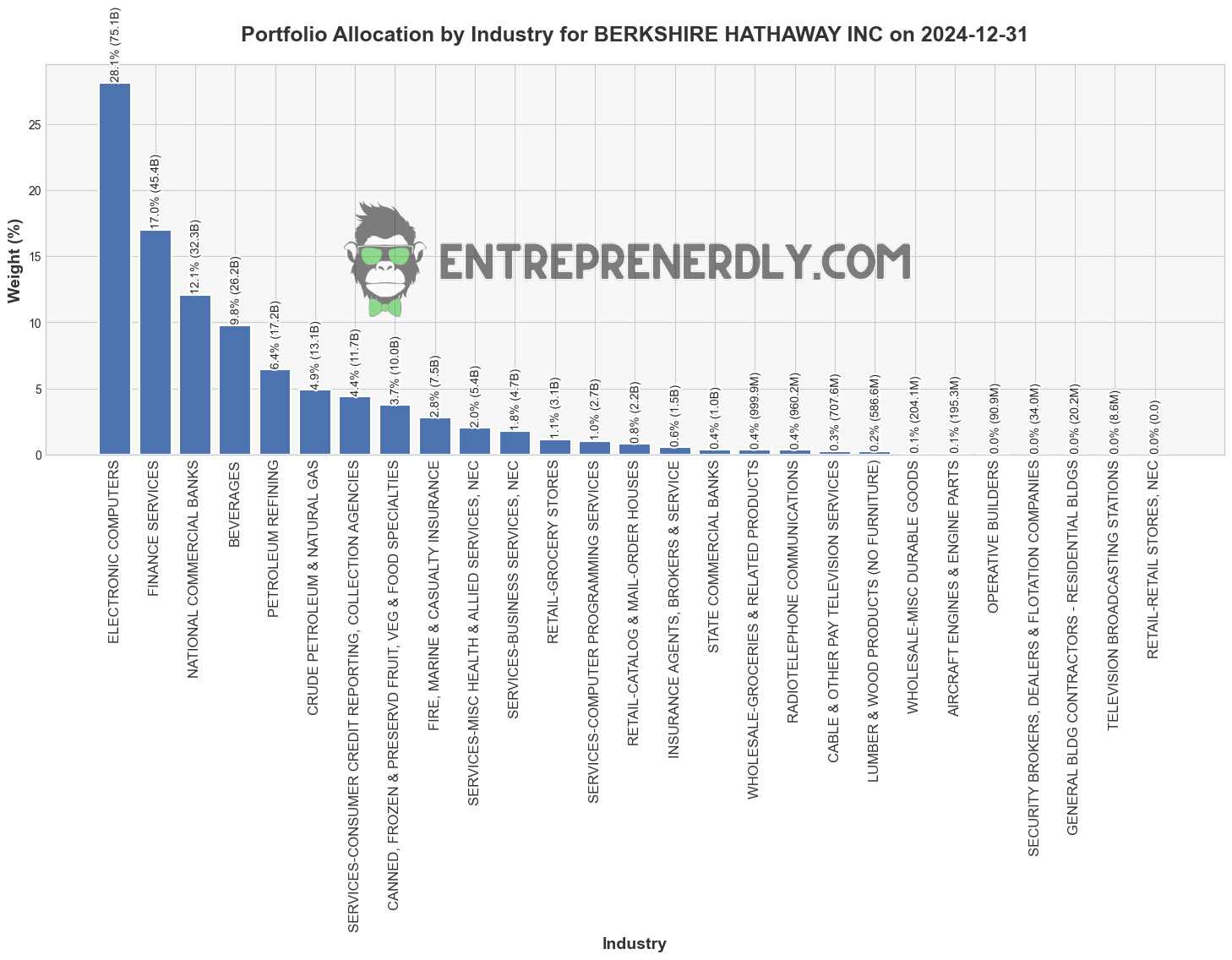

Portfolio Industry Allocation

Figure 3: Portfolio Allocation by Industry (As of December 31, 2024) - An overview of Berkshire Hathaway's industry exposure.

Buffett’s allocations also show a preference for durable, cash-generating businesses across key industries:

- Electronic Computers (Apple): 28.1% ($75.1B)

- Finance Services: 17.0% ($45.4B)

- National Commercial Banks: 12.1% ($32.3B)

- Beverages (Coca-Cola): 9.8% ($26.2B)

- Petroleum Refining: 6.4% ($17.2B)

- Crude Petroleum & Natural Gas: 4.9% ($13.1B)

- Consumer Credit & Financial Services: 4.4% ($11.7B)

- Food Manufacturing (Kraft Heinz): 3.7% ($10.0B)

- Insurance & Risk Management: 2.8% ($7.5B)

- Healthcare Services: 2.0% ($5.4B)

The dominance of financial services, consumer staples, and energy suggests Berkshire is balancing between stable cash flows and inflation hedges.

Buffett’s recent moves into consumer discretionary — like Domino’s Pizza — show a potential shift toward more resilient, consumer-driven investments.

Key Market Trends Impacting Berkshire’s Strategy

- Regulatory Compliance: The reduction of BAC below 10% avoids enhanced SEC scrutiny, while keeping AXP below 20% prevents its classification as a bank holding company.

- Valuation Discipline: The Apple and Coca-Cola sales align with Buffett’s philosophy of trimming positions at premium valuations.

- Cash as a Strategic Asset: Berkshire’s $325.2 billion cash position — 88% in short-term Treasuries — acts as dry powder for acquisitions and a hedge against market overvaluation.

- Sector Rotation: Moving into Domino’s and trimming energy stocks like Chevron and Occidental Petroleum suggests a focus on recession-resistant consumer spending.

Final Take: Buffett Is Playing the Long Game

With a 14% portfolio turnover — above his 10-year average — Buffett is making more moves than usual.

He’s stacking cash, cutting risk, and selectively adding where he sees opportunity.

If history repeats, Berkshire’s cautious positioning means one thing: Buffett is waiting for a crash to deploy his war chest.

The question is: When will he strike?

Newsletter