Experience the Future of Intelligent Investing Today

Back To Top

Experience the Future of Intelligent Investing Today

Volatility is one of the most important concepts in markets. We use it to manage risk, forecast returns, and price options.

But there’s a problem — most of what we observe in high-frequency data isn’t real volatility.

It’s noise.

Bid-ask spreads, order flow imbalances, and execution latency all inflate short-term return variation.

This distortion makes it easy to misinterpret risk, especially when backtesting intraday strategies or analyzing realized volatility.

In this article, we show how to separate market signal from microstructure noise using real intraday and long-term open-source data. Along the way, we’ll cover:

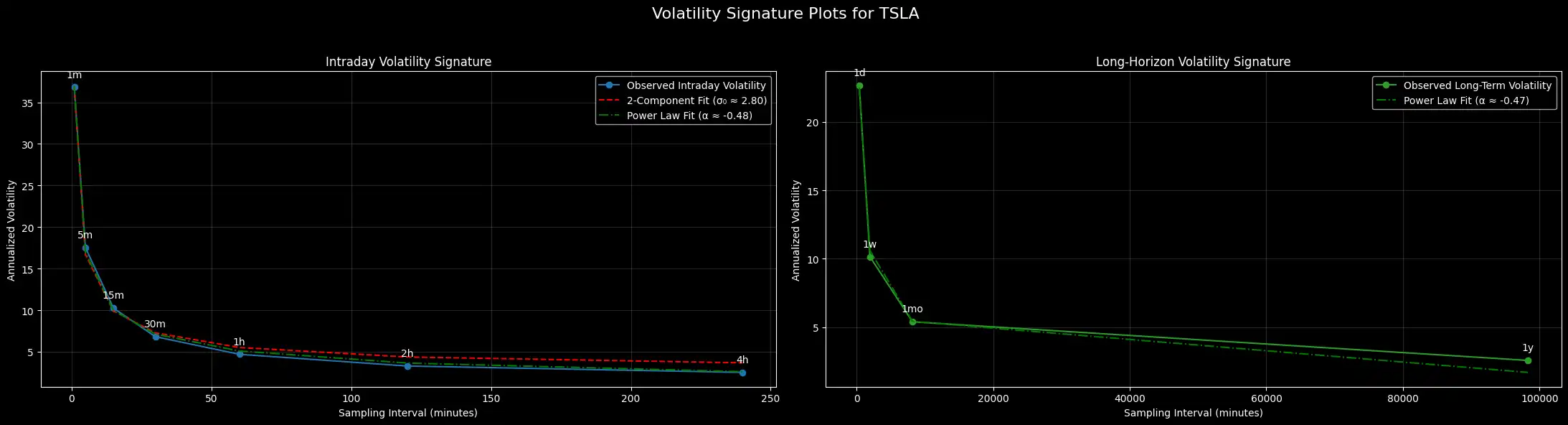

How does volatility behave when we change the lens through which we observe the market?

If you measure Tesla’s volatility every minute, you’ll find it erratic and jumpy.

But zoom out to weekly or monthly intervals, and things begin to smooth out. What’s happening here is structure. And that structure can be modeled.

Let’s build volatility signature plots using both intraday and long-horizon data.

These plots reveal how volatility decays with time, and more importantly, whether that decay is driven by meaningful market dynamics or distorted by noise.

Volatility is not scale-invariant — it compresses as you aggregate returns over time. This decay often follows a power-law form:

What does α tell us?

Fitting this model across both intraday and long-horizon data quantifies the rate at which markets “smooth out” over time.

Short-term volatility is often inflated by noise — order book imbalances, bid-ask spreads, execution slippage.

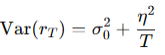

To separate signal from noise, we use a two-component model:

This model helps us identify the minimum volatility floor 0² and quantify how much observed variation is due to meaningless noise.

As T increases, the noise term decays and we converge toward the latent signal.

Below is the implementation for both models using 1-minute intraday data and daily OHLC data for TSLA.

We fit both models to the intraday signature, and only the power-law model to long-horizon data.

import yfinance as yf

import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

import warnings

warnings.filterwarnings('ignore')

from scipy.optimize import curve_fit

plt.style.use('dark_background')

Newsletter