Expected Price

Model future price ranges from market trends and proven historical patterns. Get a clear and forward-looking view of market movement.

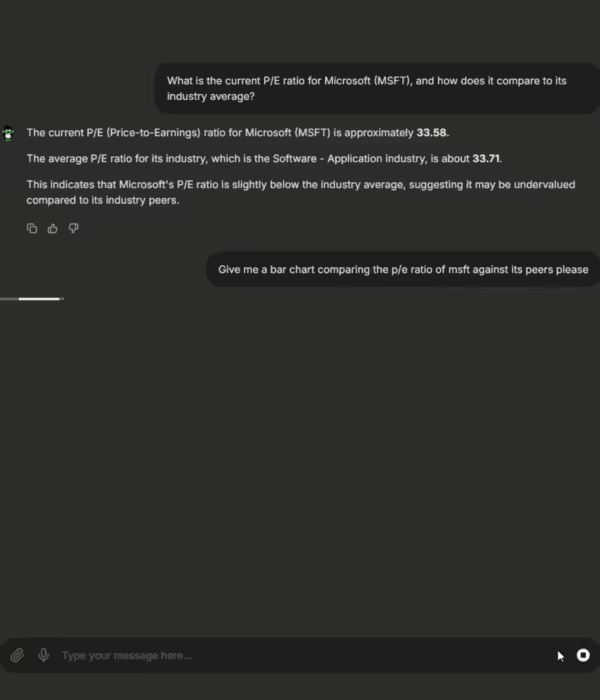

Intrinsic Value Modeling

Combine traditional valuation metrics with real-time sentiment. Understand the company’s value alongside public opinion and news influence.

Trends & Patterns

Track price trends and news to stay updated on market movements. See how recent developments and sentiment shifts could affect asset direction.